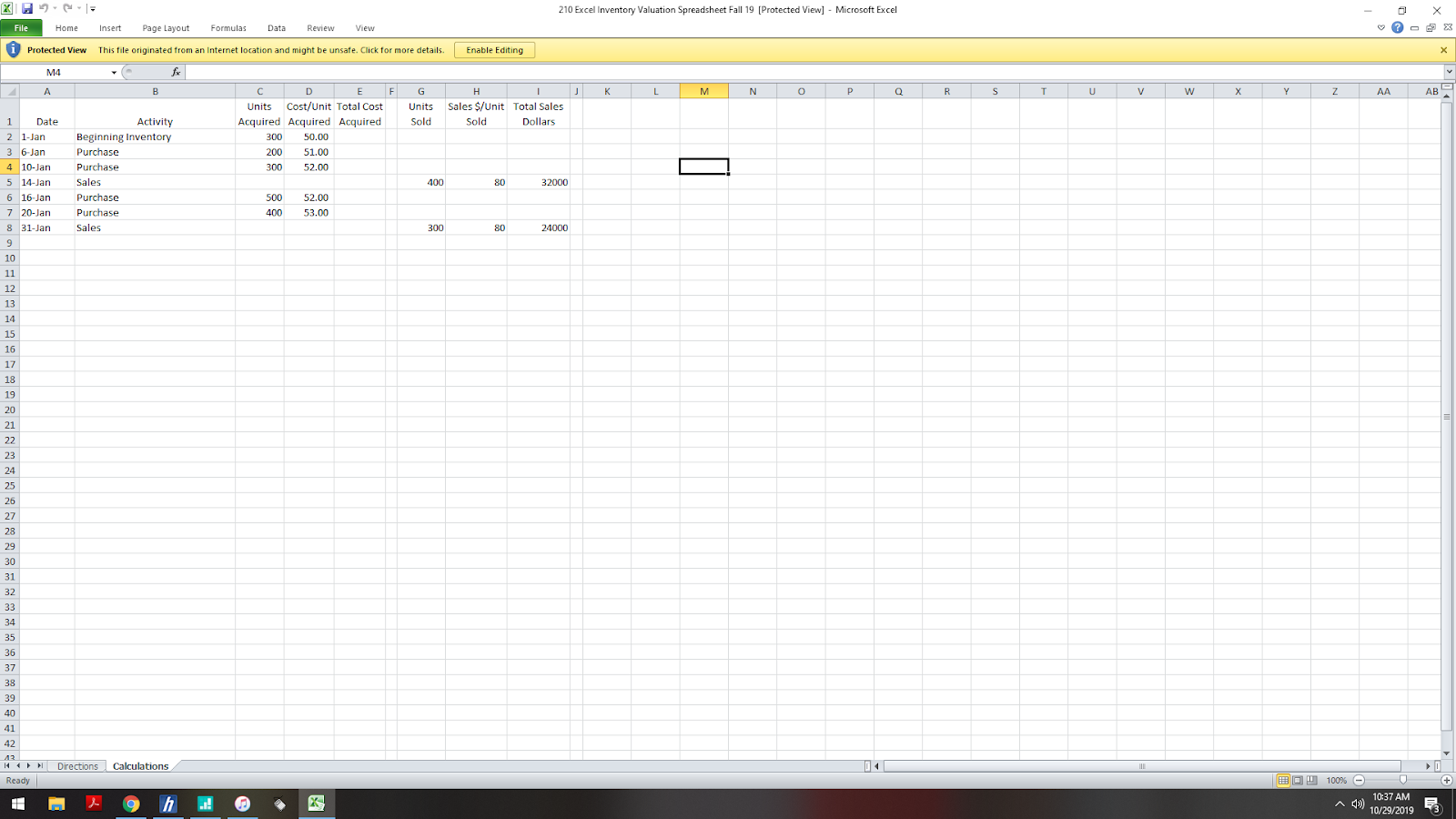

Question: 210 Excel Inventory Valuation Spreadsheet Fall 19 [Protected View] Microsoft Excel X File Page Layout Formulas Data Review View Home Insert iProtected View This file

![210 Excel Inventory Valuation Spreadsheet Fall 19 [Protected View] Microsoft Excel](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea001538553_47666ea001497269.jpg)

210 Excel Inventory Valuation Spreadsheet Fall 19 [Protected View] Microsoft Excel X File Page Layout Formulas Data Review View Home Insert iProtected View This file originated from an Internet location and might be unsafe. Click for more details Enable Editing fr A8 C D F G J K O 1 2 Excel Project Pt2: Inventory Valuation Methods The assumptions are provided at the top of the Calculations worksheet. In making the calculations in each step link to the assumptions. All 3 calculations should be make using formulas in the cells. Part 1. Using the information provided on the Calculations tab caloculate the cost of goods and ending inventory using each of the following methods FIFO, LIFO, and weighted average. The calculations should be in the same format that I use in my video sample problem. Provide 4 proper headings and format the numbers properly. Part 2. To check your work you need to make a table calculating the cost of goods sold based on the beginning inventory, purchases, and ending inventory. You need to make these calculations based on your calculations in step 1. Use the formula provided in your text book on 5 page 201. You should subtotal to get the goods available for sale in your tabular form. 6 Part 3. Based on your calculations in part 2 determine the impact on cost of goods sold if the inventory is understated. 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 14 HDirections Calculations 100% O Ready 10:34 AM h C 10/29/2019 210 Excel Inventory Valuation Spreadsheet Fall 19 [Protected View] Microsoft Excel X File Home Insert Page Layout Formulas Data Review View 1Protected View This file originated from an Internet location and might be unsafe. Click for more details Enable Editing X fr 4 A D E F G J K L P R U V W Y Z AA AB Cost/Unit Total Cost Sales $/Unit Total Sales Units Units Acquired Acquired Acquired Sold Sold Dollars 1 Date Activity 2 1-Jan Beginning Inventory 300 50.00 3 6-Jan Purchase 200 51.00 Purchase 4 10-Jan 300 52.00 5 14-Jan Sales 400 80 32000 52.00 6 16-Jan Purchase 500 Purchase 7 20-Jan 400 53.00 Sales 300 8 31-Jan 80 24000 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 13 14 Directions Calculations 100 % Ready 10:37 AM h C 10/29/2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts