Question: 21,23 262 Chapter 5 Finance Construct the payment schedule for the loan in lem 11. Construct the payment schedule for the first four ments of

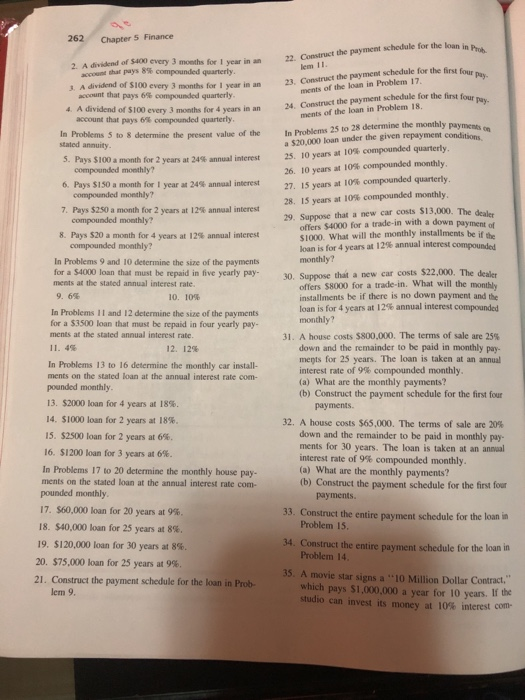

262 Chapter 5 Finance Construct the payment schedule for the loan in lem 11. Construct the payment schedule for the first four ments of the loan in Problem 17. 24. Construct the payment schedule for the first fou ments of the loan in Problem 18. A dividend of $400 every 3 months for 1 year in an count that pays 8% compounded quarterly A dividend of S100 every 3 months for 1 year in an account that pays 6% compounded quarterly 4. A dividend of $100 every 3 months for 4 years in an account that pays 6% compounded quarterly. In Problems 5 to 8 determine the present value of the stated annuity. 5. Pays $100 a month for 2 years at 24% annual interest compounded monthly? 6. Pays $150 a month for 1 year at 24 annual interest compounded monthly? 7. Pays $250 a month for 2 years at 125 annual interest compounded monthly? Bahams 25 to 28 determine the monthly payment $20.000 loan under the given repayment condition 25. 10 years at 10% compounded quarterly 26. 10 years at 10% compounded monthly 27. 15 years at 10% compounded quarterly. 28. 15 years at 10% compounded monthly 29. Sure that a new car costs $13,000. The de offers $4000 for a trade-in with a down payment S1000. What will the monthly installments bei loan is for 4 years at 12% annual interest compounded monthly? 30. Suppose that a new car costs $22,000. The dealer offers SN000 for a trade-in. What will the monthly installments be if there is no down payment and the Joan is for 4 years at 12% annual interest compounded monthly? 31. A house costs $800,000. The terms of sale are 25% down and the remainder to be paid in monthly pay- ments for 25 years. The loan is taken at an annual interest rate of 9% compounded monthly. (a) What are the monthly payments? (b) Construct the payment schedule for the first four payments. 8. Pays $20 a month for 4 years at 12% annual interest compounded monthly? In Problems 9 and 10 determine the size of the payments for a $4000 loan that must be repaid in five yearly pay- ments at the stated annual interest rate. 9.6% 10. 109 In Problems 11 and 12 determine the size of the payments for a $3500 loan that must be repaid in four yearly pay- ments at the stated annual interest rate. 11.45 12.12% In Problems 13 to 16 determine the monthly car install- ments on the stated loan at the annual interest rate com- pounded monthly 13. $2000 loan for 4 years at 18%. 14. S1000 loan for 2 years at 18%. 15. $2500 loan for 2 years at 6% 16. $1200 loan for 3 years at 6%. In Problems 17 to 20 determine the monthly house pay- ments on the stated loan at the annual interest rate com pounded monthly 17. $60,000 loan for 20 years at 9%. 18. $40,000 loan for 25 years at 8%. 19. $120,000 loan for 30 years at 8%. 20. $75,000 loan for 25 years at 9% 21. Construct the payment schedule for the loan in Prob lem 9. 32. A house costs $65.000. The terms of sale are 20% down and the remainder to be paid in monthly pay. ments for 30 years. The loan is taken at an annual interest rate of 9% compounded monthly. (a) What are the monthly payments? (b) Construct the payment schedule for the first four payments. 33. Construct the entire payment schedule for the loan in Problem 15. 34. Construct the entire payment schedule for the loan in Problem 14. 35. A movie star signs a "10 Million Dollar Contract. which pays $1.000.000 a year for 10 years. If the studio can invest its money at 10% interest com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts