Question: 21-24, or more Oa August I, a comapany signed a nine nsonth note receivable of $60,000 with interest at a rate of 12%. They properly

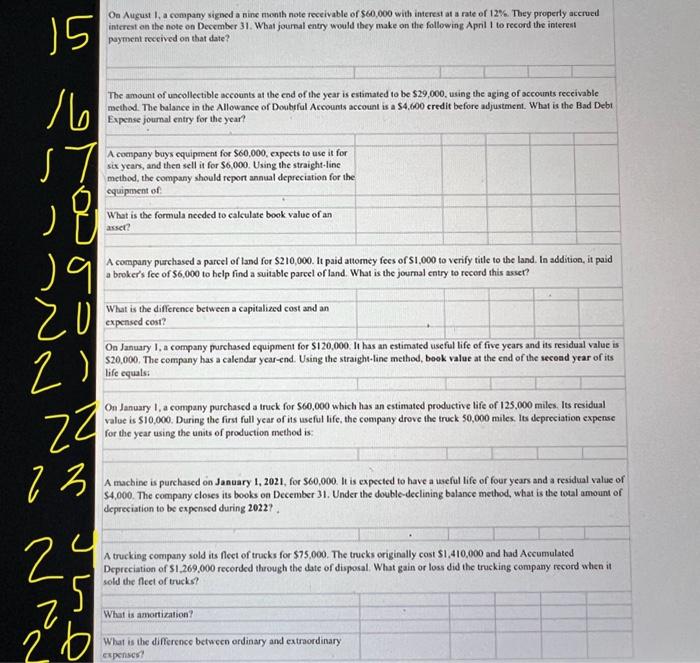

Oa August I, a comapany signed a nine nsonth note receivable of $60,000 with interest at a rate of 12%. They properly accruct interest en the note on December 31. What joumal entry would they make on the following April I to record the interent payment received on that date? The amount of uncollectible accounts at the cad of the year is estintated to be $29,000, using the aging of accounts receivable method. The balance in the Allowance of Doubtful Accounts account is a $4,600 credit before adjustment. What is the Bad Debt Expense joumal entry for the year? A company buys equipment for $60,000, expecti to uve it for six years, and then sell it for $6.000. Using the straight-line method, the company should report annual depreciation for the equipment of What is the formula necded to calculate book value of an asset? A company piachased a parcel of Iand for $210,000. It paid attomcy fecs of $1,000 to verify title to the land. In addition, it paid a broker's fec of $6,000 to help find a suitable pareel of land. What is the journal entry to recerd this asset? What is the difference between a capitalized cost and an expensed cost? Oa January I, a company prurchased equipment for $120,000. It has an estimated useful life of five years and its residual value is $20,000. The company has a calendar year-end. Using the straight-line method, book value at the end of the second year of its life cquals: On January I, a company purchased a truck for $60,000 which has an estimated productive life of 125,000 miles. Its residual value is $10,000. During the first full year of its useful life, the company drove the truck 50,000 miles. Its depreciation expense for the year using the units of production method is: A machine is purchased on January 1,2021 , for 560,000 . It is expected to have a useful life of four years and a residual value of $4,000. The company closes its books on December 31. Under the double-declining balance method, what is the total amount of depreciation to be expensed during 2022?. A trucking company sold its flect of trucks for $75.000. The trucks originally cost $1,410.000 and had Accumulated Depreciation of 51,269,000 recorded through the date of disporal, What gain or loss did the trueking company tecord when it sold the fleet of trucks? What is amortization? What is the differenco betwecn ordinary and extraordinary expensest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts