Question: 21-7. Use these key financial data from the most recent annual report of Rancho, Inc., o answer the questions that follow Sales Net income Total

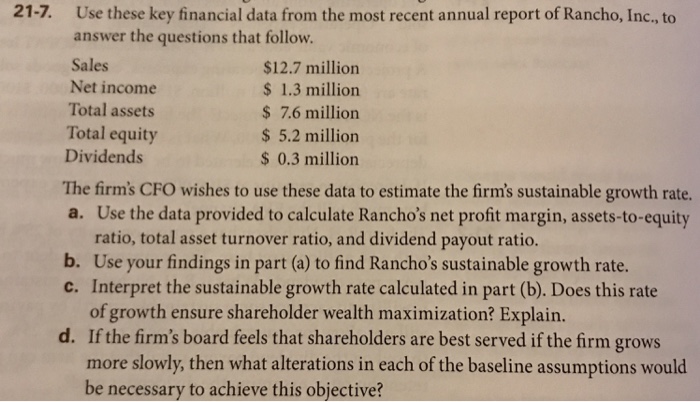

21-7. Use these key financial data from the most recent annual report of Rancho, Inc., o answer the questions that follow Sales Net income Total assets Total equity Dividends $12.7 million $ 1.3 million $ 7.6 million $ 5.2 million $0.3 million The firm's CFO wishes to use these data to estimate the firm's sustainable growth rate. a. Use the data provided to calculate Rancho's net profit margin, assets-to-equity equity ratio, total asset turnover ratio, and dividend payout b. Use your findings in part (a) to find Rancho's sustainable growth rate. c. Interpret the sustainable growth rate calculated in part (b). Does this rate of growth ensure shareholder wealth maximization? Explain. If the firm's board feels that shareholders are best served if the firm grows more slowly, then what alterations in each of the baseline assumptions would be necessary to achieve this objective? d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts