Question: 2.2 2.3 E2.2 (LO 1) Selected transactions for M. Acosta, an interior decorator, in her first month of business, are as follows. Jan. 2 Invested

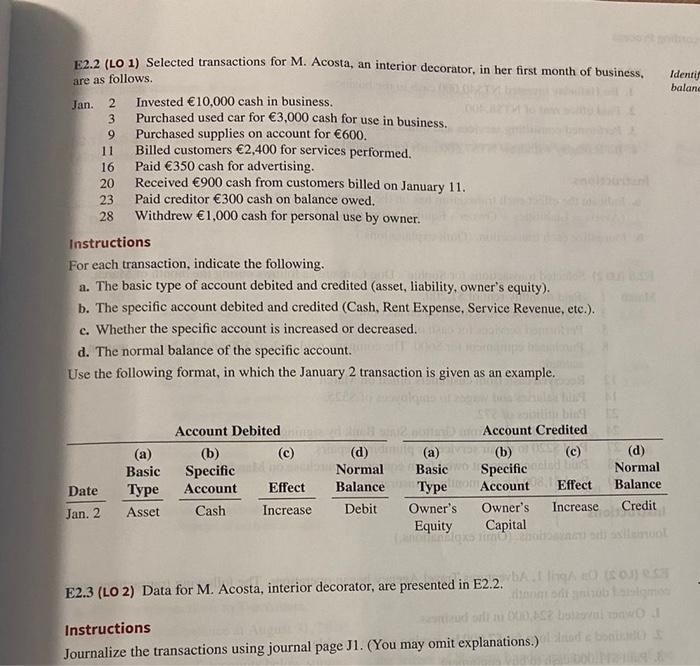

E2.2 (LO 1) Selected transactions for M. Acosta, an interior decorator, in her first month of business, are as follows. Jan. 2 Invested 10,000 cash in business. Purchased used car for 3,000 cash for use in business. Purchased supplies on account for 600. Billed customers 2,400 for services performed. Paid 350 cash for advertising. Received 900 cash from customers billed on January 11 . Paid creditor 300 cash on balance owed. 28 Withdrew 1,000 cash for personal use by owner. Instructions For each transaction, indicate the following. a. The basic type of account debited and credited (asset, liability, owner's equity). b. The specific account debited and credited (Cash, Rent Expense, Service Revenue, etc.). c. Whether the specific account is increased or decreased. d. The normal balance of the specific account. Use the following format, in which the January 2 transaction is given as an example. E2.3 (LO 2) Data for M. Acosta, interior decorator, are presented in E2.2. Instructions Journalize the transactions using journal page J1. (You may omit explanations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts