Question: 2.2. (5 MARKS) TASK 2: Select an industry from the alternatives in Table 2. You will base this decision on the following screening criteria: Market

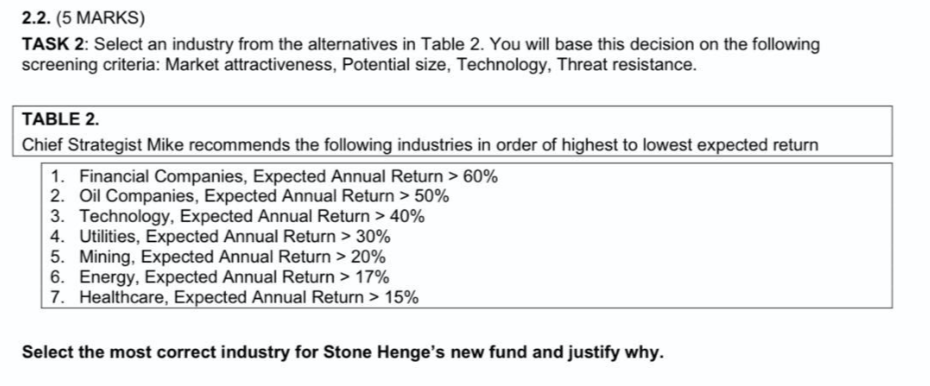

2.2. (5 MARKS) TASK 2: Select an industry from the alternatives in Table 2. You will base this decision on the following screening criteria: Market attractiveness, Potential size, Technology, Threat resistance. TABLE 2. Chief Strategist Mike recommends the following industries in order of highest to lowest expected return 1. Financial Companies, Expected Annual Return > 60% 2. Oil Companies, Expected Annual Return > 50% 3. Technology, Expected Annual Return > 40% 4. Utilities, Expected Annual Return > 30% 5. Mining, Expected Annual Return > 20% 6. Energy, Expected Annual Return > 17% 7. Healthcare, Expected Annual Return > 15% Select the most correct industry for Stone Henge's new fund and justify why. 2.2. (5 MARKS) TASK 2: Select an industry from the alternatives in Table 2. You will base this decision on the following screening criteria: Market attractiveness, Potential size, Technology, Threat resistance. TABLE 2. Chief Strategist Mike recommends the following industries in order of highest to lowest expected return 1. Financial Companies, Expected Annual Return > 60% 2. Oil Companies, Expected Annual Return > 50% 3. Technology, Expected Annual Return > 40% 4. Utilities, Expected Annual Return > 30% 5. Mining, Expected Annual Return > 20% 6. Energy, Expected Annual Return > 17% 7. Healthcare, Expected Annual Return > 15% Select the most correct industry for Stone Henge's new fund and justify why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts