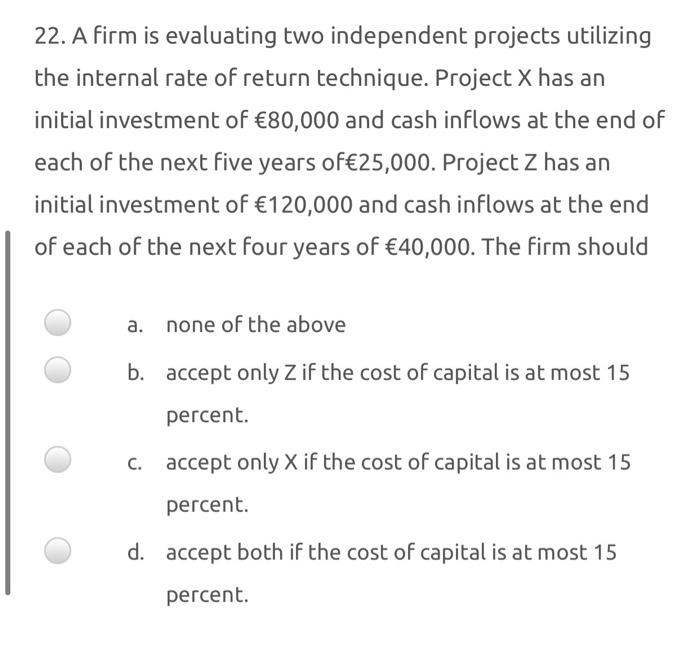

Question: 22. A firm is evaluating two independent projects utilizing the internal rate of return technique. Project X has an initial investment of 80,000 and cash

22. A firm is evaluating two independent projects utilizing the internal rate of return technique. Project X has an initial investment of 80,000 and cash inflows at the end of each of the next five years of25,000. Project Z has an initial investment of 120,000 and cash inflows at the end of each of the next four years of 40,000. The firm should a. none of the above b. accept only Z if the cost of capital is at most 15 percent. C. accept only X if the cost of capital is at most 15 percent. d. accept both if the cost of capital is at most 15 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts