Question: 22. Consider two mutually exclusive projects, A and B. Project A requires an initial cash outlay of $100,000 followed by five years of $30,000 cash

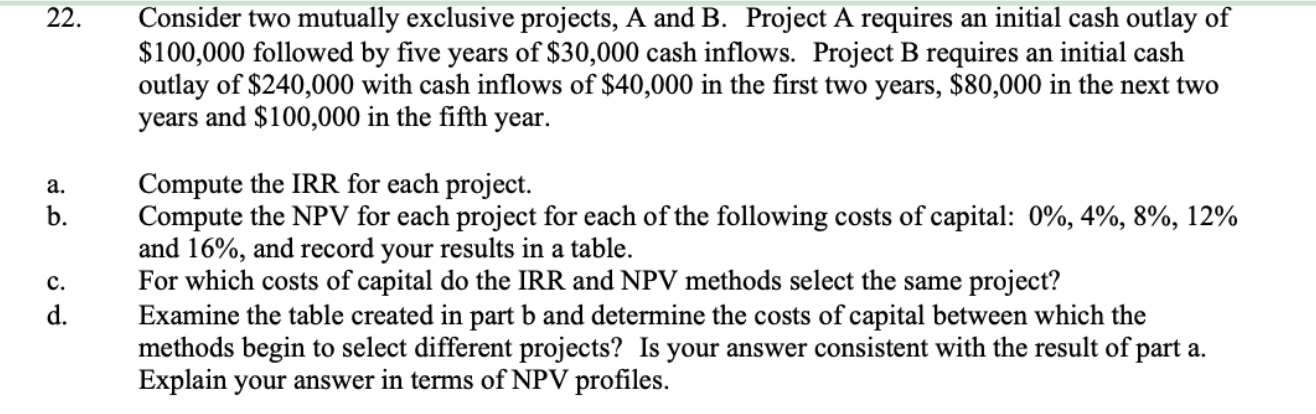

22. Consider two mutually exclusive projects, A and B. Project A requires an initial cash outlay of $100,000 followed by five years of $30,000 cash inflows. Project B requires an initial cash outlay of $240,000 with cash inflows of $40,000 in the first two years, $80,000 in the next two years and $100,000 in the fifth year. a. Compute the IRR for each project. b. Compute the NPV for each project for each of the following costs of capital: 0%, 4%, 8%, 12% and 16%, and record your results in a table. C. For which costs of capital do the IRR and NPV methods select the same project? d. Examine the table created in part b and determine the costs of capital between which the methods begin to select different projects? Is your answer consistent with the result of part a. Explain your answer in terms of NPV profiles. 22. Consider two mutually exclusive projects, A and B. Project A requires an initial cash outlay of $100,000 followed by five years of $30,000 cash inflows. Project B requires an initial cash outlay of $240,000 with cash inflows of $40,000 in the first two years, $80,000 in the next two years and $100,000 in the fifth year. a. Compute the IRR for each project. b. Compute the NPV for each project for each of the following costs of capital: 0%, 4%, 8%, 12% and 16%, and record your results in a table. C. For which costs of capital do the IRR and NPV methods select the same project? d. Examine the table created in part b and determine the costs of capital between which the methods begin to select different projects? Is your answer consistent with the result of part a. Explain your answer in terms of NPV profiles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts