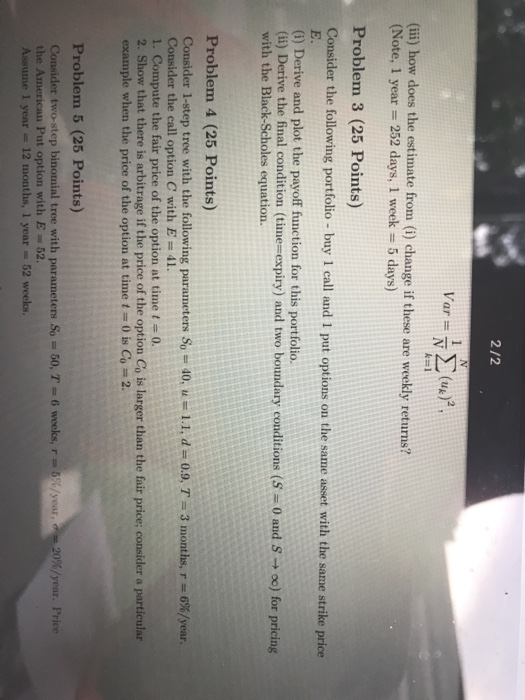

Question: 2/2 (ii) how does the estimate from (G) change if these are weekly returns? (Note, 1 year 252 days, 1 week 5 days) Problem 3

2/2 (ii) how does the estimate from (G) change if these are weekly returns? (Note, 1 year 252 days, 1 week 5 days) Problem 3 (25 Points) Consider the following portfolio buy 1 call and 1 put options on the same asset with the same strike price E. (i) Derive and plot the payof function for this portfolio. with the Black-Scholes equation. (i) Derive the final condition (ti (i) Derive the final condition (time expiry) and two boundary conditions :0 an (S 0 ad So) for pricing Problem 4 (25 Points) Consider l-step tree with the following parameters So = 40, u-1.1, d 0.9, T= 3 months, r = 6%/year. Consider the call option C with E 41 1. Compute the fair price of the option at time t0. 2. Show that there is arbitrage if the price of the option Co is larger than the fair price; consider a particular example when the price of the option at time t-0 is Co 2. Problem 5 (25 Points) %/year. Price Consider two-step binomial tree with parameters So the Assume 1 year 12 months, 1 year 52 weeks. 50, T-s 6 weeks, r-5%/year, Put option with E 52 2/2 (ii) how does the estimate from (G) change if these are weekly returns? (Note, 1 year 252 days, 1 week 5 days) Problem 3 (25 Points) Consider the following portfolio buy 1 call and 1 put options on the same asset with the same strike price E. (i) Derive and plot the payof function for this portfolio. with the Black-Scholes equation. (i) Derive the final condition (ti (i) Derive the final condition (time expiry) and two boundary conditions :0 an (S 0 ad So) for pricing Problem 4 (25 Points) Consider l-step tree with the following parameters So = 40, u-1.1, d 0.9, T= 3 months, r = 6%/year. Consider the call option C with E 41 1. Compute the fair price of the option at time t0. 2. Show that there is arbitrage if the price of the option Co is larger than the fair price; consider a particular example when the price of the option at time t-0 is Co 2. Problem 5 (25 Points) %/year. Price Consider two-step binomial tree with parameters So the Assume 1 year 12 months, 1 year 52 weeks. 50, T-s 6 weeks, r-5%/year, Put option with E 52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts