Question: 22. Traditional IRA Characteristics. (Obj. 4) For each statement, check true or false. a. Contributions to a nonworking spouse's IRA must be equal to the

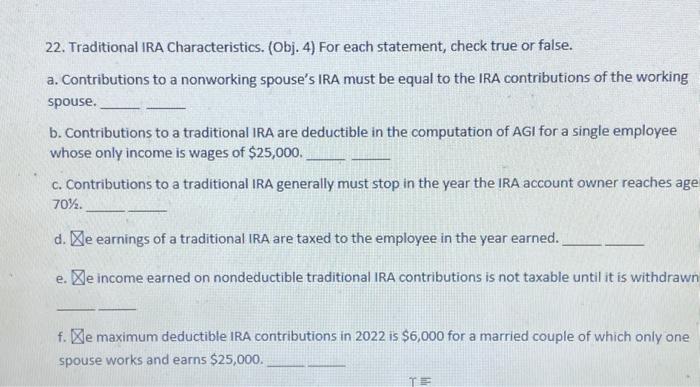

22. Traditional IRA Characteristics. (Obj. 4) For each statement, check true or false. a. Contributions to a nonworking spouse's IRA must be equal to the IRA contributions of the working spouse. b. Contributions to a traditional IRA are deductible in the computation of AGI for a single employee whose only income is wages of $25,000. c. Contributions to a traditional IRA generally must stop in the year the IRA account owner reaches age 70%. d. De earnings of a traditional IRA are taxed to the employee in the year earned. e. De income earned on nondeductible traditional IRA contributions is not taxable until it is withdrawn f. e maximum deductible IRA contributions in 2022 is $6,000 for a married couple of which only one spouse works and earns $25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts