Question: 22. Up until now, HCL Inc. has only produced acids. In an attempt to diversify, HCL Inc. is contemplating an investment in a new project

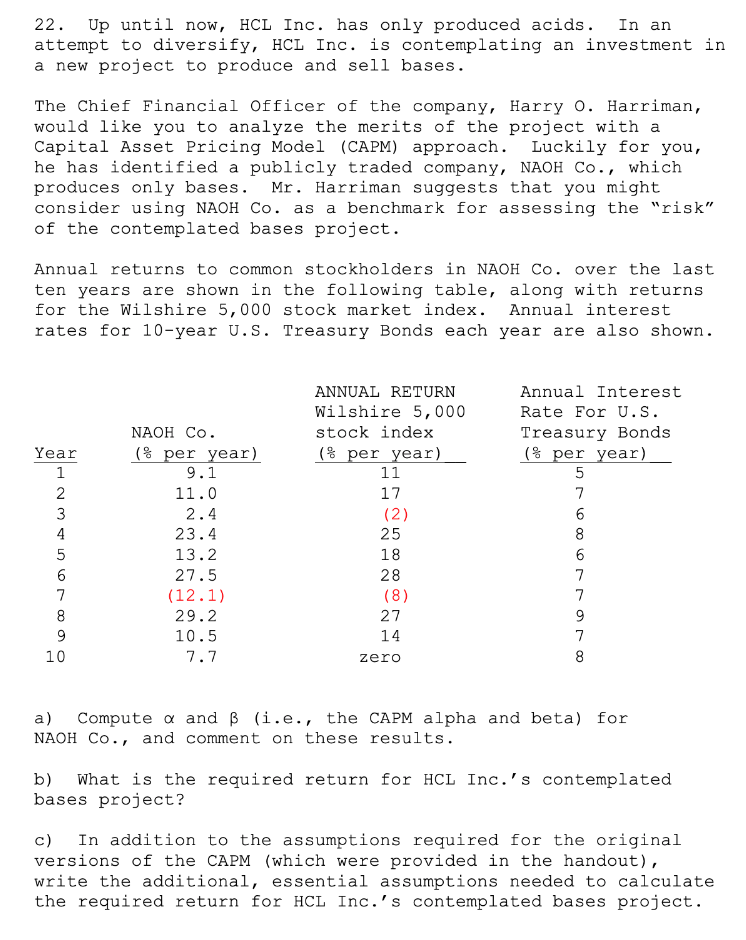

22. Up until now, HCL Inc. has only produced acids. In an attempt to diversify, HCL Inc. is contemplating an investment in a new project to produce and sell bases. The Chief Financial officer of the company, Harry o. Harriman, would like you to analyze the merits of the project with a Capital Asset Pricing Model (CAPM) approach. Luckily for you, he has identified a publicly traded company, NAOH Co., which produces only bases. Mr. Harriman suggests that you might consider using NAOH Co. as a benchmark for assessing the "risk" of the contemplated bases project. Annual returns to common stockholders in NAOH Co. over the last ten years are shown in the following table, along with returns for the Wilshire 5,000 stock market index. Annual interest rates for 10-year U.S. Treasury Bonds each year are also shown. a) Compute and (i.e., the CAPM alpha and beta) for NAOH Co., and comment on these results. b) What is the required return for HCL Inc.'s contemplated bases project? c) In addition to the assumptions required for the original versions of the CAPM (which were provided in the handout), write the additional, essential assumptions needed to calculate the required return for HCL Inc.'s contemplated bases project. 22. Up until now, HCL Inc. has only produced acids. In an attempt to diversify, HCL Inc. is contemplating an investment in a new project to produce and sell bases. The Chief Financial officer of the company, Harry o. Harriman, would like you to analyze the merits of the project with a Capital Asset Pricing Model (CAPM) approach. Luckily for you, he has identified a publicly traded company, NAOH Co., which produces only bases. Mr. Harriman suggests that you might consider using NAOH Co. as a benchmark for assessing the "risk" of the contemplated bases project. Annual returns to common stockholders in NAOH Co. over the last ten years are shown in the following table, along with returns for the Wilshire 5,000 stock market index. Annual interest rates for 10-year U.S. Treasury Bonds each year are also shown. a) Compute and (i.e., the CAPM alpha and beta) for NAOH Co., and comment on these results. b) What is the required return for HCL Inc.'s contemplated bases project? c) In addition to the assumptions required for the original versions of the CAPM (which were provided in the handout), write the additional, essential assumptions needed to calculate the required return for HCL Inc.'s contemplated bases project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts