Question: 22. value: 2.00 points A $1,000 par value bond was issued 15 years ago at a 12 percent coupon rate. It currently has 15 years

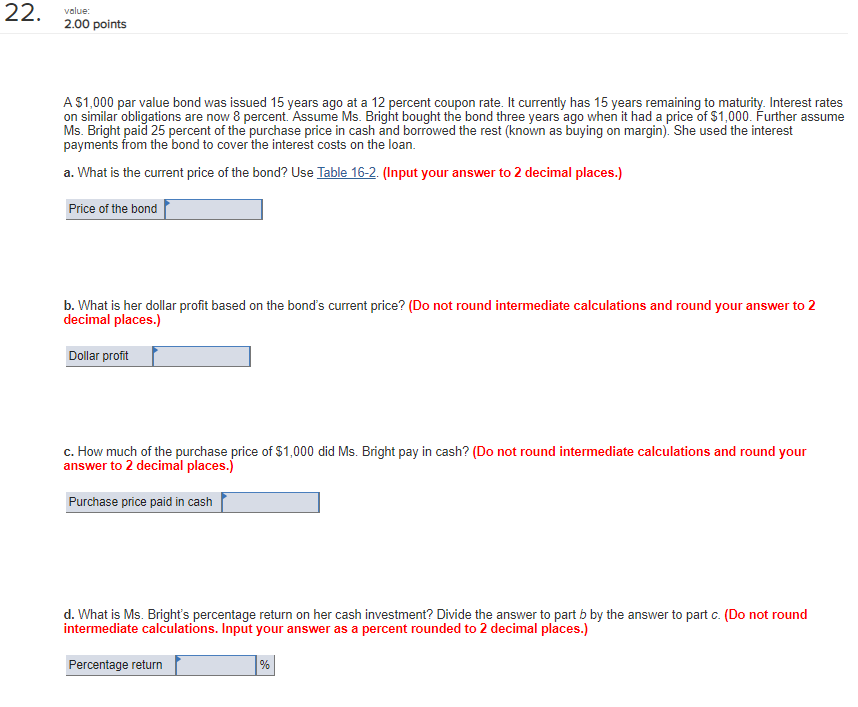

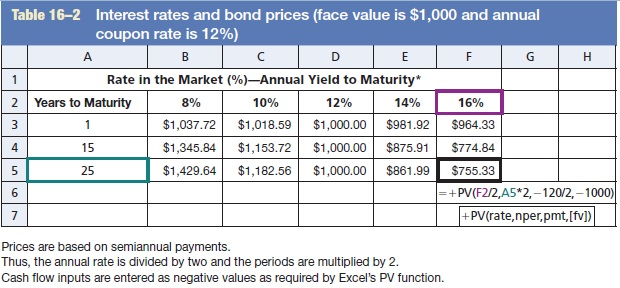

22. value: 2.00 points A $1,000 par value bond was issued 15 years ago at a 12 percent coupon rate. It currently has 15 years remaining to maturity. Interest rates on similar obligations are now 8 percent. Assume Ms. Bright bought the bond three years ago when it had a price of $1,000. Further assume Ms. Bright paid 25 percent of the purchase price in cash and borrowed the rest (known as buying on margin). She used the interest payments from the bond to cover the interest costs on the loan. a. What is the current price of the bond? Use Table 16-2. (Input your answer to 2 decimal places.) Price of the bond b. What is her dollar profit based on the bond's current price? (Do not round intermediate calculations and round your answer to 2 decimal places.) Dollar profit c. How much of the purchase price of $1,000 did Ms. Bright pay in cash? (Do not round intermediate calculations and round your answer to 2 decimal places.) Purchase price paid in cash d. What is Ms. Bright's percentage return on her cash investment? Divide the answer to part b by the answer to part c. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Percentage return % Table 16-2 Interest rates and bond prices (face value is $1,000 and annual coupon rate is 12%) C D E F G H Rate in the Market (%)-Annual Yield to Maturity* 2 Years to Maturity 8% 10% 12% 14% 16% | 3 1 $1,037.72 $1,018.59 $1,000.00 $981.92 $964.33 14 15 $1,345.84 $1,153.72 $1,000.00 $875.91 $774.84 2 5 $1,429.64 $1,182.56 $1,000.00 $861.99 | $755.33 =+PV(F212, A5*2,-120/2,-1000) +PV(rate, nper,pmt, [fv]) 5 Prices are based on semiannual payments. Thus, the annual rate is divided by two and the periods are multiplied by 2. Cash flow inputs are entered as negative values as required by Excel's PV function

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts