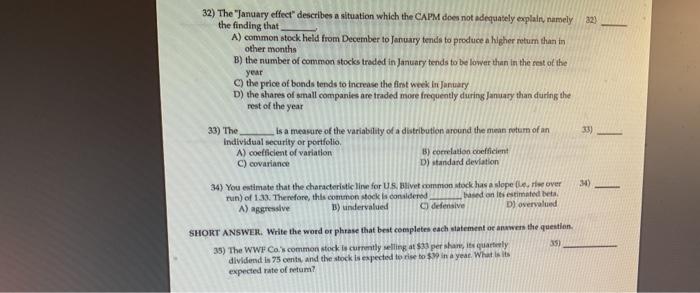

Question: 223 32) The January effect describes a situation which the CAPM does not adequately explain namely the finding that A) common stock held from December

223 32) The "January effect" describes a situation which the CAPM does not adequately explain namely the finding that A) common stock held from December to January tends to produce a higher rotur than in other months B) the number of common stocks traded in January tends to be lower than in the rest of the year C) the price of bonds tends to increase the first week in January D) the shares of small companies are traded more frequently during January than during the rest of the year 33) The Is a measure of the variability of a distribution around the mean rotum of an Individual security or portfolio A) coefficient of variation ) correlation coefficient C) covariance D) standard deviation 33) 3) 34) You estimate that the characteristic line for US. Blivet common stock has a slope we over run) of 1.33. Therefore, this common stock is considered based on its estimated beta A) aggressive 1) undervalued defensive D) overvalued SHORT ANSWER. Write the word or phrase that best completes each statement of answer the question. 35) The WWF Co.'s common stock is currently selling at $33 pershan, it quarterly 350 dividend is 75 cents, and the stock is expected to rise to Win a year. What is its expected rate of reum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts