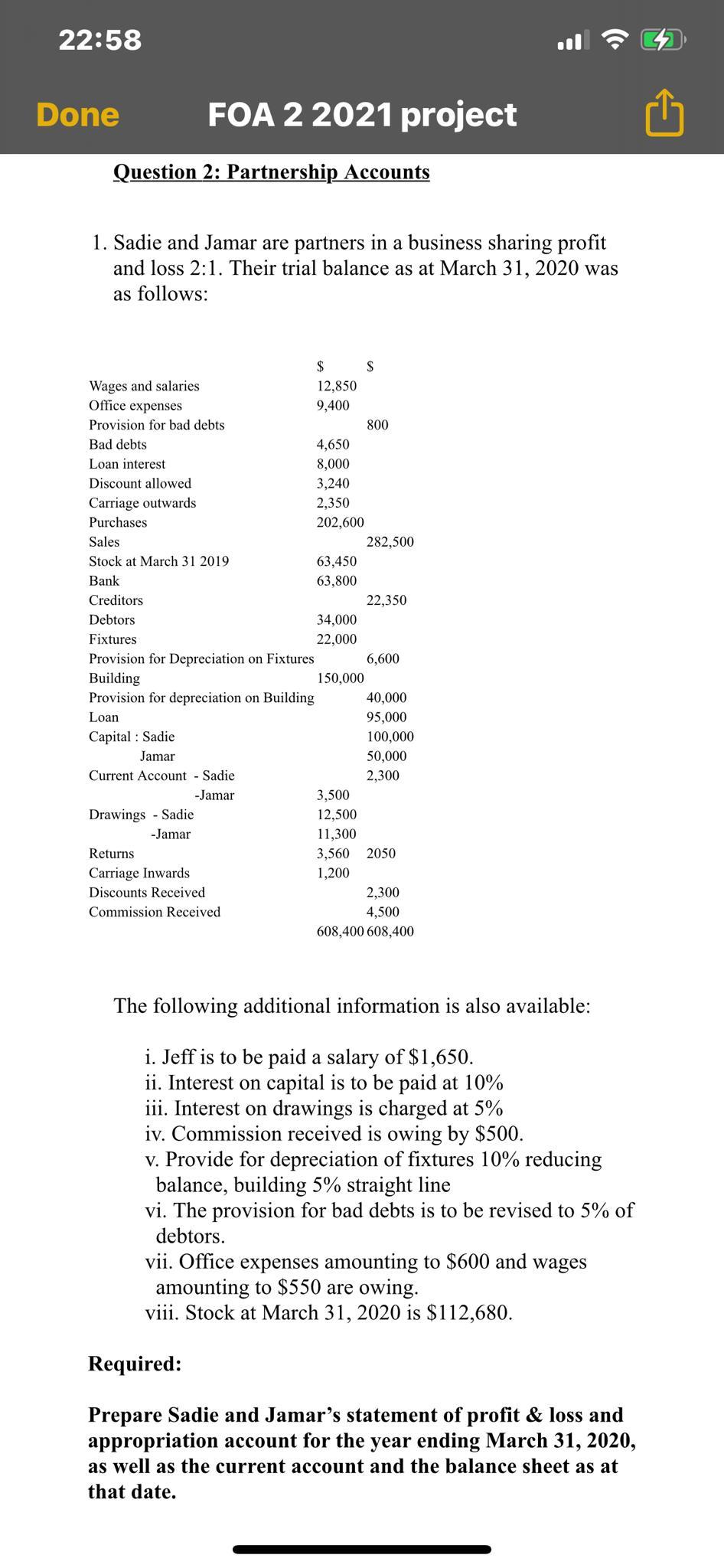

Question: 22:58 )) Done FOA 2 2021 project Question 2: Partnership Accounts 1. Sadie and Jamar are partners in a business sharing profit and loss 2:1.

22:58 )) Done FOA 2 2021 project Question 2: Partnership Accounts 1. Sadie and Jamar are partners in a business sharing profit and loss 2:1. Their trial balance as at March 31, 2020 was as follows: $ $ Wages and salaries 12,850 Office expenses 9,400 Provision for bad debts 800 Bad debts 4,650 Loan interest 8,000 Discount allowed 3,240 Carriage outwards 2,350 Purchases 202,600 Sales 282,500 Stock at March 31 2019 63,450 Bank 63,800 Creditors 22,350 Debtors 34,000 Fixtures 22,000 Provision for Depreciation on Fixtures 6,600 Building 150,000 Provision for depreciation on Building 40,000 Loan 95,000 Capital : Sadie 100,000 Jamar 50,000 Current Account - Sadie 2,300 -Jamar 3,500 Drawings - Sadie 12,500 -Jamar 11,300 Returns 3,560 2050 Carriage Inwards 1,200 Discounts Received 2,300 Commission Received 4,500 608,400 608,400 The following additional information is also available: i. Jeff is to be paid a salary of $1,650. ii. Interest on capital is to be paid at 10% iii. Interest on drawings is charged at 5% iv. Commission received is owing by $500. v. Provide for depreciation of fixtures 10% reducing balance, building 5% straight line vi. The provision for bad debts is to be revised to 5% of debtors. vii. Office expenses amounting to $600 and wages amounting to $550 are owing. viii. Stock at March 31, 2020 is $112,680. Required: Prepare Sadie and Jamar's statement of profit & loss and appropriation account for the year ending March 31, 2020, as well as the current account and the balance sheet as at that date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts