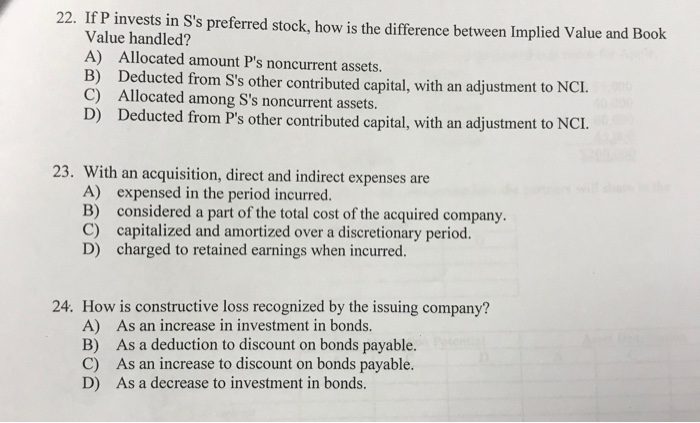

Question: 22I invests in S's preferred stock, how is the difference between Implied Value and Book Value handled? A) Allocated amount P's noncurrent assets. B) Deducted

22I invests in S's preferred stock, how is the difference between Implied Value and Book Value handled? A) Allocated amount P's noncurrent assets. B) Deducted from S's other contributed capital, with an adjustment to NCI C) Allocated among S's noncurrent assets. D) Deducted from P's other contributed capital, with an adjustment to NCI. 23. With an acquisition, direct and indirect expenses are B) C) D) expensed in the period incurred. considered a part of the total cost of the acquired company. capitalized and amortized over a discretionary period. charged to retained earnings when incurred. 24. How is constructive loss recognized by the issuing company? A) B) C) D) As an increase in investment in bonds. As a deduction to discount on bonds payable. As an increase to discount on bonds payable. As a decrease to investment in bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts