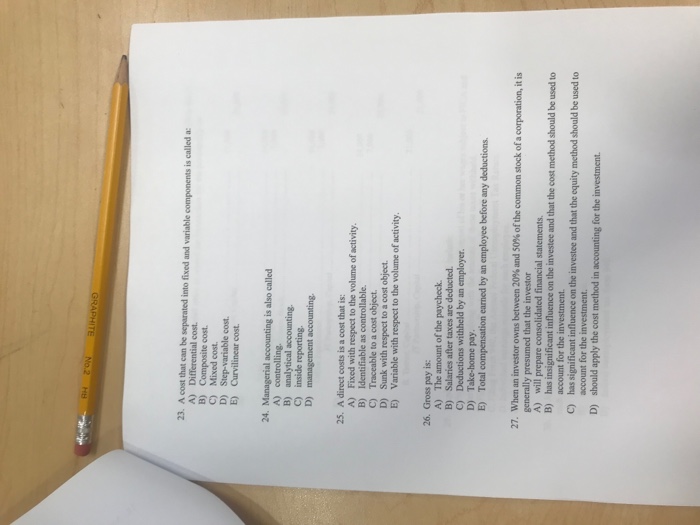

Question: 23. A cost that can be separated into fixed and variable components is called a Differential cost B) Composite cost. C) Mixed cost E) Curvilinear

23. A cost that can be separated into fixed and variable components is called a Differential cost B) Composite cost. C) Mixed cost E) Curvilinear cost C) inside 25. A direct costs is a cost that is: A) Fixed with respect to the volume of activity B) Identifiable as controllable. C) Traceable to a cost object D) Sunk with respect to a cost object E) Variable with respect to the volume of activity 26. Gross pay is: A) The amount of the paycheck B) Salaries after taxes are deducted C) Deductions withheld by an employer. D) Take-home pay B Total compensation earned by an employee before any deductions. 27, when an investor owns between 20% and 50% of the common stock ofa corporation, it is generally presumed that the investor A) will prepare consolidated financial statements B) has insignificant influence on the investee and that the cost method should be used to account for the investment. hassignificant influence on the investee and that the equity method should be used to account for the C) D) should apply the cost method in accounting for the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts