Question: 23. A decrease in dividend payment can be interpreted that: A Management believes the dividend payment can be sustained B. There is an expectation of

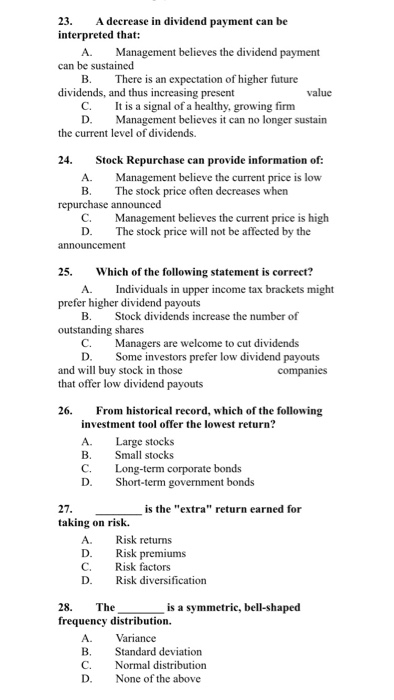

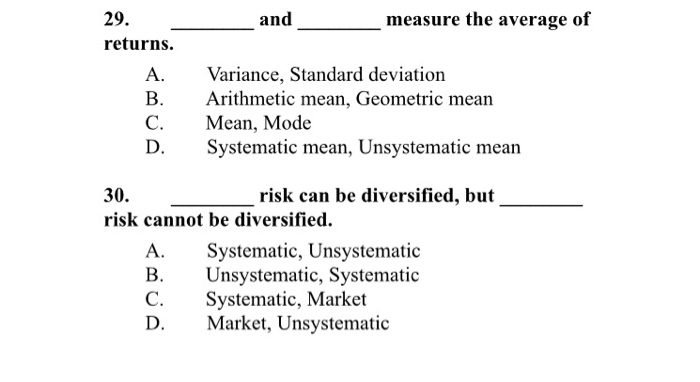

23. A decrease in dividend payment can be interpreted that: A Management believes the dividend payment can be sustained B. There is an expectation of higher future dividends, and thus increasing present value C. It is a signal of a healthy, growing firm D. Management believes it can no longer sustain the current level of dividends. 24. Stock Repurchase can provide information of: A. Management believe the current price is low B. The stock price often decreases when repurchase announced C. Management believes the current price is high D. The stock price will not be affected by the announcement 25. Which of the following statement is correct? A. Individuals in upper income tax brackets might prefer higher dividend payouts B. Stock dividends increase the number of outstanding shares C. Managers are welcome to cut dividends D. Some investors prefer low dividend payouts and will buy stock in those companies that offer low dividend payouts 26. From historical record, which of the following investment tool offer the lowest return? A. Large stocks B. Small stocks C. Long-term corporate bonds D. Short-term government bonds is the "extra" return earned for taking on risk. A. Risk returns D. Risk premiums C. Risk factors D. Risk diversification 28. The is a symmetric, bell-shaped frequency distribution. A. Variance B. Standard deviation C. Normal distribution D. None of the above 29. and measure the average of returns. A. Variance, Standard deviation Arithmetic mean, Geometric mean Mean, Mode Systematic mean, Unsystematic mean 30. risk can be diversified, but risk cannot be diversified. A. Systematic, Unsystematic Unsystematic, Systematic Systematic, Market Market, Unsystematic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts