Question: 2-3 answer this two questions please. Lorenta Company has provided the following data (ignore income taxes): 2022 revenues were $105,700. 2022 expenses were $48,800. Dividends

2-3

answer this two questions please.

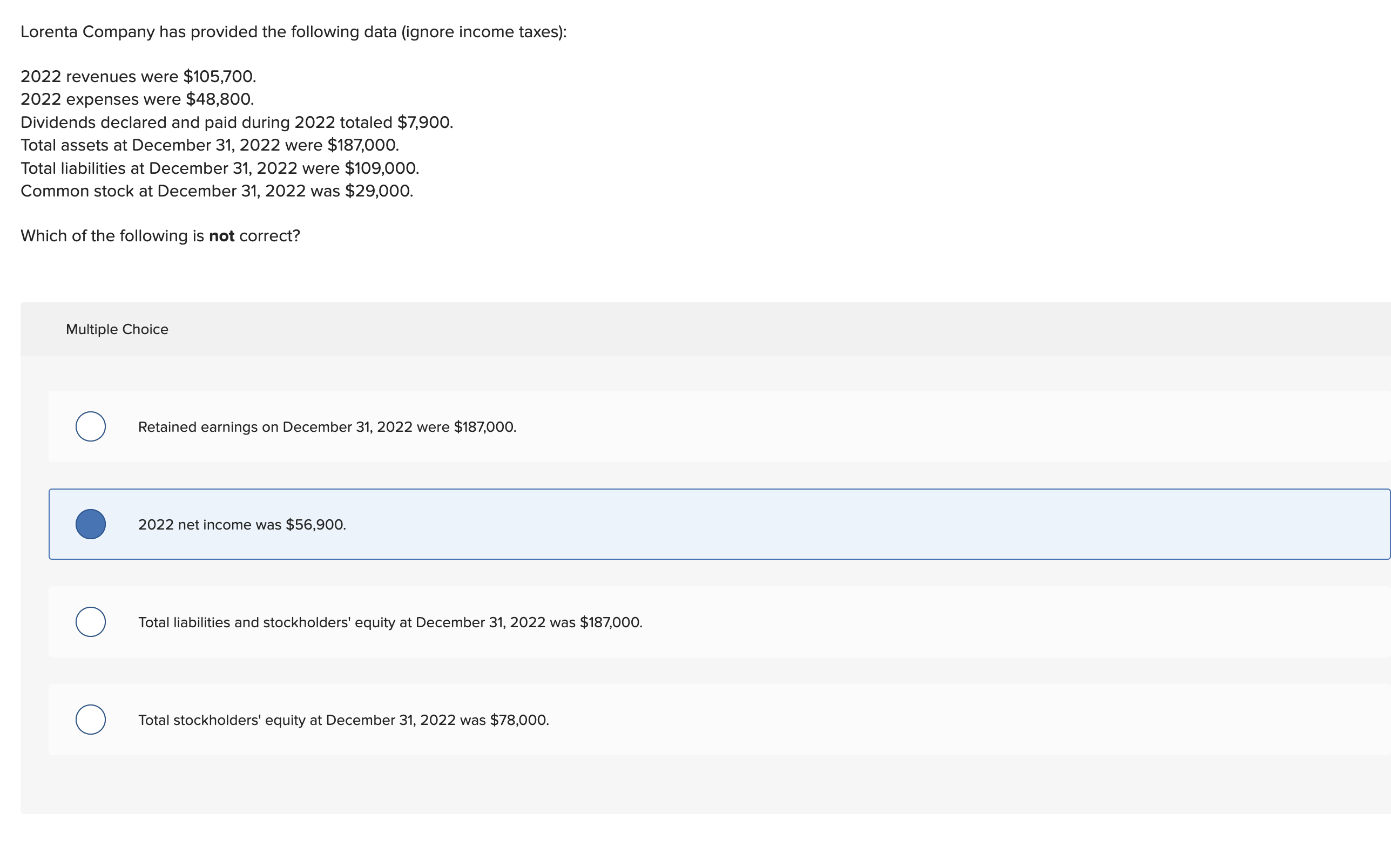

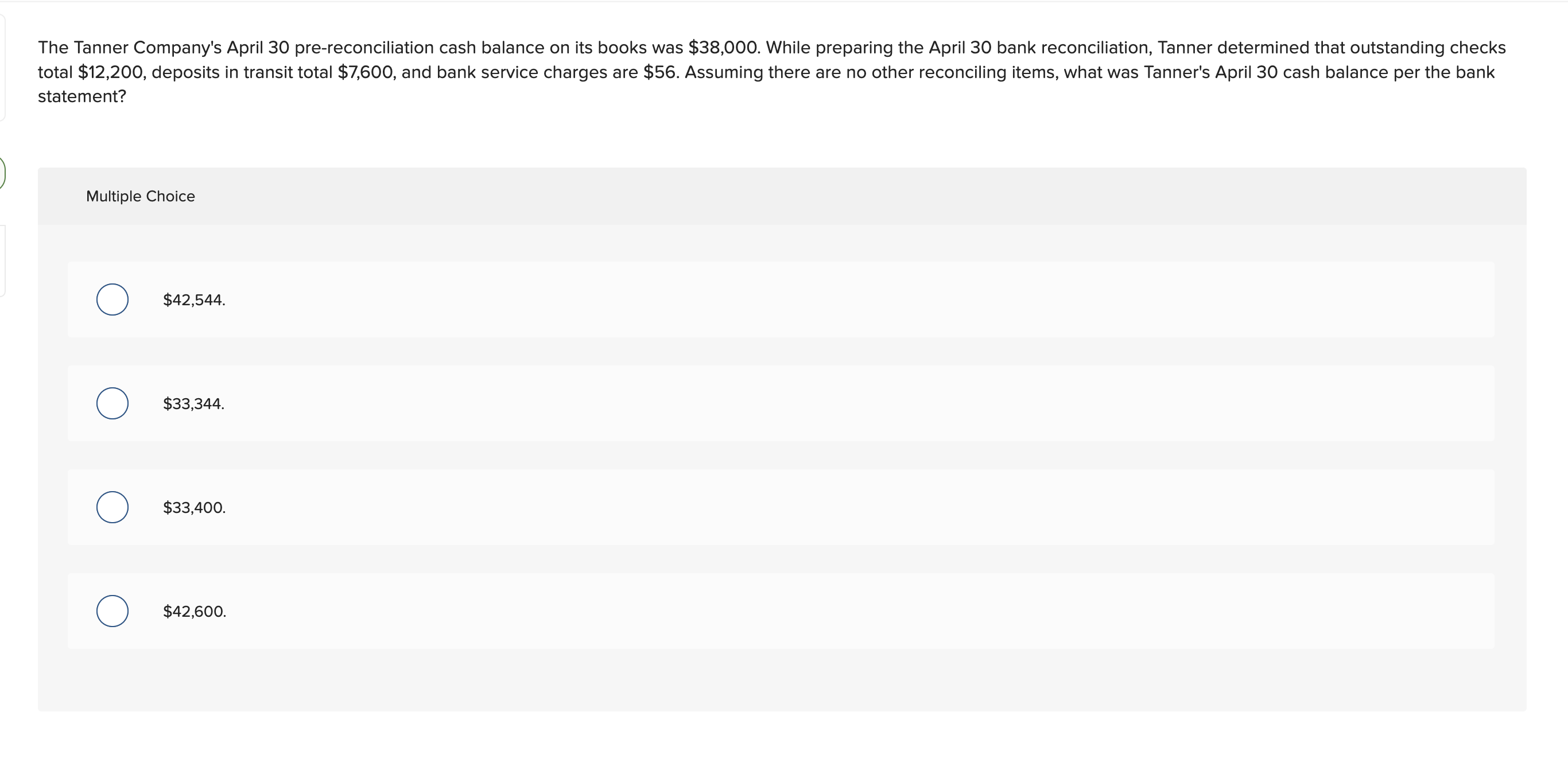

Lorenta Company has provided the following data (ignore income taxes): 2022 revenues were $105,700. 2022 expenses were $48,800. Dividends declared and paid during 2022 totaled $7,900. Total assets at December 31, 2022 were $187,000. Total liabilities at December 31, 2022 were $109,000. Common stock at December 31, 2022 was $29,000. Which of the following is not correct? Multiple Choice Retained earnings on December 31, 2022 were \$187,000. 2022 net income was $56,900. Total liabilities and stockholders' equity at December 31, 2022 was $187,000. Total stockholders' equity at December 31, 2022 was $78,000. The Tanner Company's April 30 pre-reconciliation cash balance on its books was $38,000. While preparing the April 30 bank reconciliation, Tanner determined that outstanding checks total $12,200, deposits in transit total $7,600, and bank service charges are $56. Assuming there are no other reconciling items, what was Tanner's April 30 cash balance per the bank statement? Multiple Choice $42,544. $33,344. $33,400. $42,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts