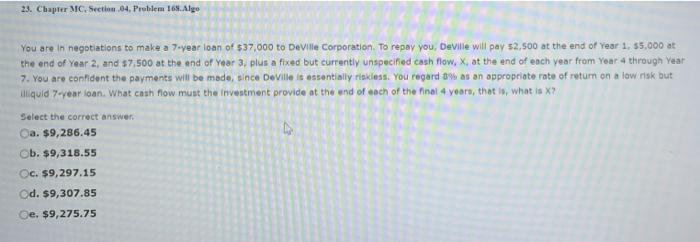

Question: 23. Chapter MC. Section .04, Problem 168. Algo You are in negotiations to make a 7-year loan of $37,000 to Deville Corporation. To repay you,

23. Chapter MC. Section .04, Problem 168. Algo You are in negotiations to make a 7-year loan of $37,000 to Deville Corporation. To repay you, Deville will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. You are confident the payments will be made, since DeVille is essentially riskless. You regard 0% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X? Select the correct answer. Ca. $9,286.45 Ob. $9,318.55 Oc. $9,297.15 Od. $9,307.85 Oe. $9,275.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts