Question: 23 D lp FIN200 - Assignment Two - Spring 2022 - Final Version Acrobat Wrap Teal General 12 Merge & Centre - %> Conditional Format

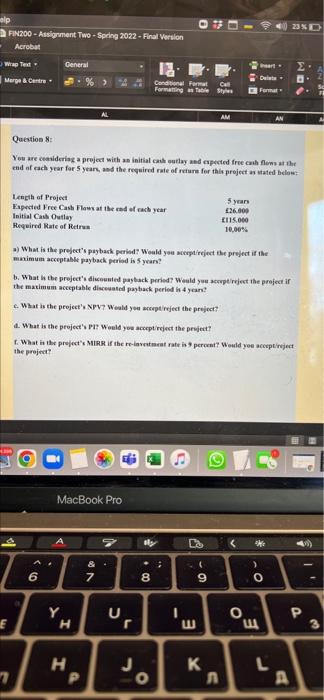

23 D lp FIN200 - Assignment Two - Spring 2022 - Final Version Acrobat Wrap Teal General 12 Merge & Centre - %> Conditional Format Call Formatting Table Styles heart Formal AM Question 8: You are considering a project with an initial case stay and expected free cash flow at the end of each year for 5 years, and the required rule of reture for this project sted below: Length of Project Expected Free Cash Flow at the end of each year Initial Cash Outlay Required Rate of Retro 5 years 26.000 115.000 10,00% 2) What is the projects payback period? Would you werpt/reject the project if the maximum acceptable payback period is 5 years! 5. What is the project's discounted payback period? Would you project the projectif the maximum seceptable discuted payback period is 4 years! 6. What is the project's NPV? Would you project the project? 2. What is the project's PI Would you accept reject the project 1. What is the projects MIRR If the release rate is 9 percent? Would you accept rejet the project MacBook Pro o * ** 6 & 7 00 8 9 O - Y H E P ur E 3 H 7 J o L A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts