Question: 23. In scenario analyses all the variable estimates in capital budgeting change to reflect the given economic scenario (boom, bust, or normal time). A) True

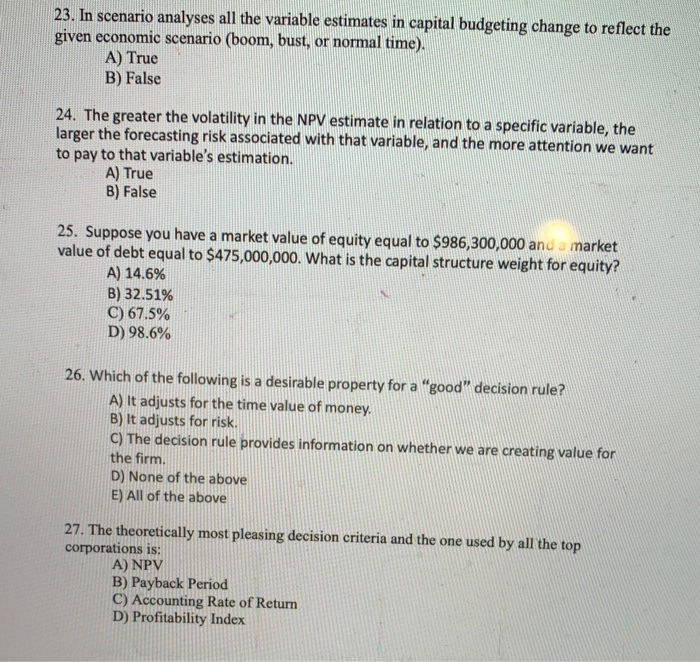

23. In scenario analyses all the variable estimates in capital budgeting change to reflect the given economic scenario (boom, bust, or normal time). A) True B) False 24. The greater the volatility in the NPV estimate in relation to a specific variable, the larger the forecasting risk associated with that variable, and the more attention we want to pay to that variable's estimation. A) True B) False 25. Suppose you have a market value of equity equal to $986,300,000 and a market value of debt equal to $475,000,000. What is the capital structure weight for equity? A) 14.6% B) 32.51% C) 67.5% D) 98.6% 26. Which of the following is a desirable property for a "good" decision rule? A) It adjusts for the time value of money. B) It adjusts for risk. C) The decision rule provides information on whether we are creating value for the firm. D) None of the above E) All of the above 27. The theoretically most pleasing decision criteria and the one used by all the top corporations is: A) NPV B) Payback Period C) Accounting Rate of Return D) Profitability Index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts