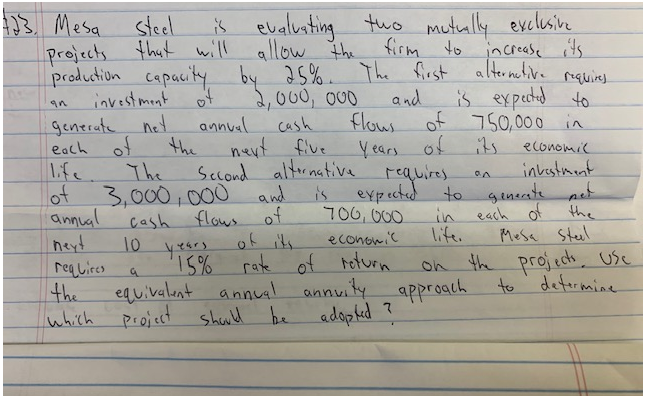

Question: 23. Mesa steel is evaluating tho mutually exclusive projects that will allow the firm to increase its production capacity by 25%. The first alternative requires

23. Mesa steel is evaluating tho mutually exclusive projects that will allow the firm to increase its production capacity by 25%. The first alternative requires an investment of 2,000,000 and is expected to generate net annual cash flows of 750,000 in each of the next five years of its economic life. The second alternative requires an investment of 3,000,000 and is expected to generate net annual cash flows of 700,000 in each of the next 10 years of its economic life. Mesa Steel requires a 15% rate of return on the projects, use the equivalent annual annuity approach to determine which project should be adopted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts