Question: 2,3 question please, I have also attached the chapter mentioned in the question. 2. Chapter 11 when the Master Printing Company filed for bankruptcy, it

2,3 question please, I have also attached the chapter mentioned in the question.

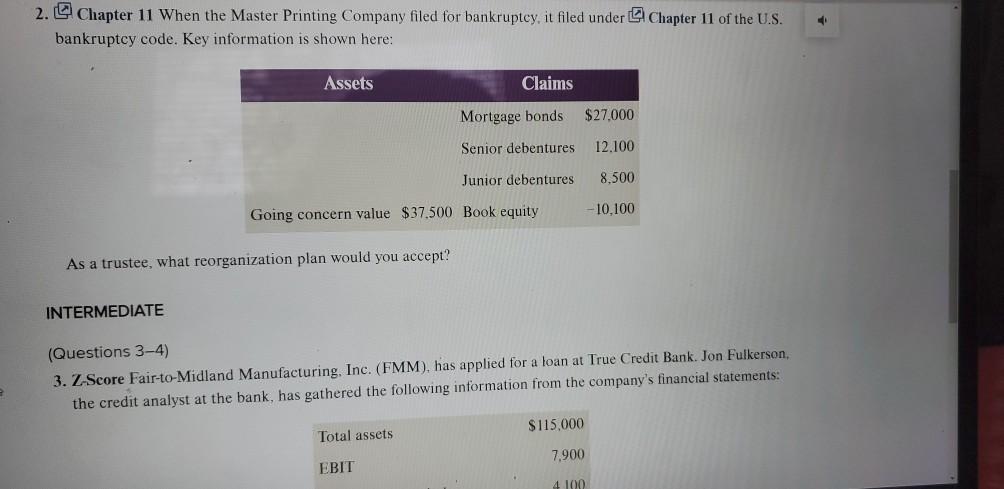

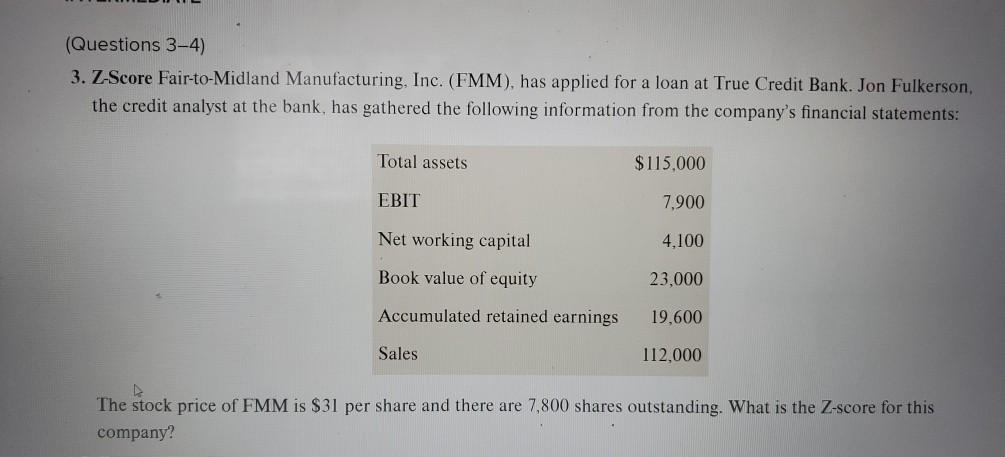

2. Chapter 11 when the Master Printing Company filed for bankruptcy, it filed under Chapter 11 of the U.S. bankruptcy code. Key information is shown here: Assets Claims Mortgage bonds $27.000 Senior debentures 12.100 Junior debentures 8,500 -10,100 Going concern value $37.500 Book equity As a trustee, what reorganization plan would you accept? INTERMEDIATE (Questions 3-4) 3. Z-Score Fair-to-Midland Manufacturing, Inc. (FMM), has applied for a loan at True Credit Bank. Jon Fulkerson, the credit analyst at the bank, has gathered the following information from the company's financial statements: $115.000 Total assets 7.900 EBIT 4 100 (Questions 3-4) 3. Z-Score Fair-to-Midland Manufacturing, Inc. (FMM), has applied for a loan at True Credit Bank. Jon Fulkerson, the credit analyst at the bank, has gathered the following information from the company's financial statements: Total assets $115,000 EBIT 7.900 4,100 Net working capital Book value of equity 23,000 Accumulated retained earnings 19,600 Sales 112,000 The stock price of FMM is $31 per share and there are 7,800 shares outstanding. What is the Z-score for this company? CHAPTER 11 Return, Risk, and the Capital Asset Pricing Model Expected returns on common stocks can vary quite a bit. One important determinant is the industry in which a company operates. For example, according to recent estimates from NYU professor Aswath Damodaran, the average expected return for the soft drink industry, which includes companies such as Coca-Cola and PepsiCo, is 7.64 percent, whereas air transportation companies such as Delta and Southwest have an average expected return of 8.83 percent. Steel companies such as Nucor and United States Steel have an average expected return of 11.55 percent. These estimates raise some obvious questions. First, why do these industry expected returns differ so much, and how are these specific numbers calculated? Also, does the higher return offered by steel industry stocks mean that investors should prefer these to, say, air transportation companies? As we will see in this chapter, the Nobel Prize-winning answers to these questions form the basis of our modern understanding of risk and return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts