Question: 23. Refer to BTZ Company. What is the net cash flow in Year 2? 12:28 a. Php298,813 b. Php473,813 c. Php498,813 d. Php626,875 050

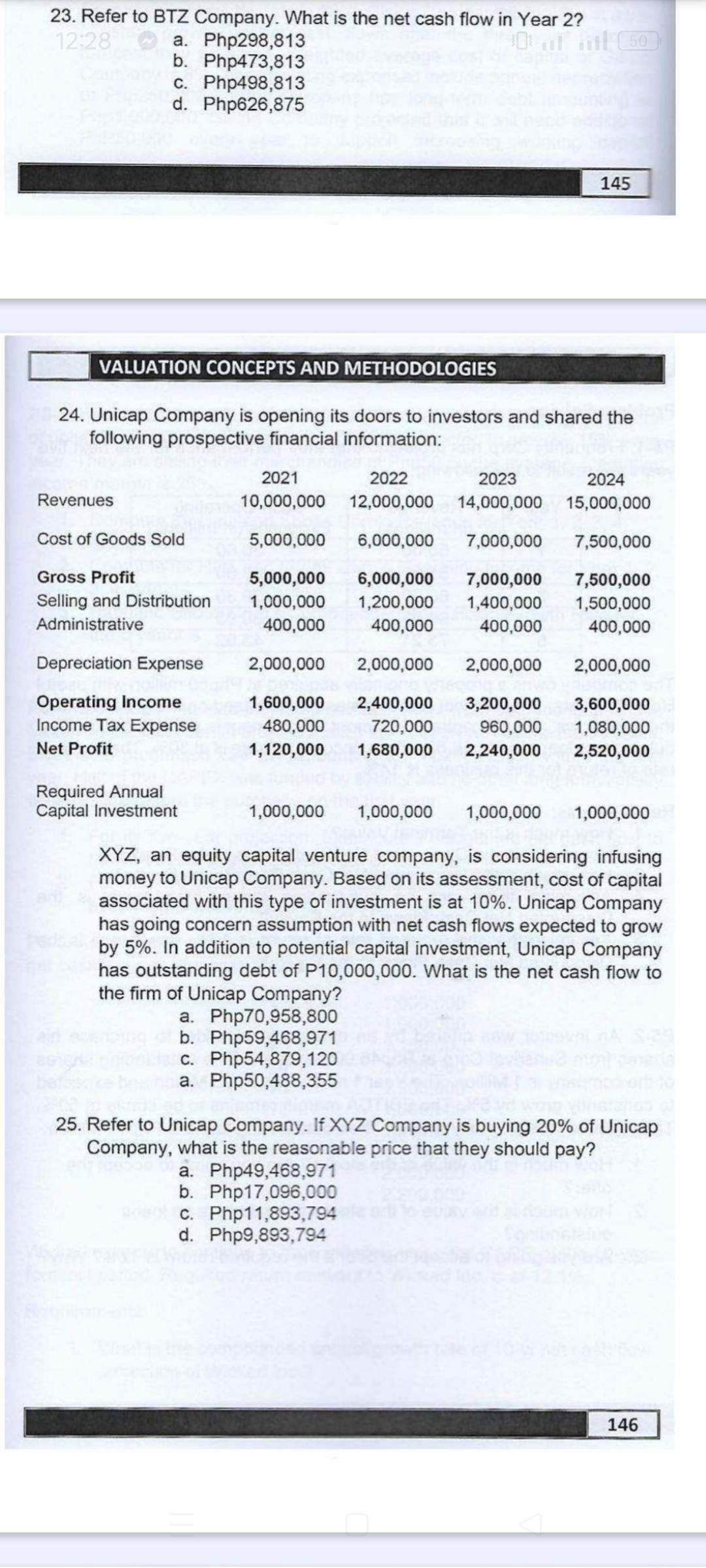

23. Refer to BTZ Company. What is the net cash flow in Year 2? 12:28 a. Php298,813 b. Php473,813 c. Php498,813 d. Php626,875 050 145 VALUATION CONCEPTS AND METHODOLOGIES 24. Unicap Company is opening its doors to investors and shared the following prospective financial information: Revenues 2021 2022 2023 10,000,000 12,000,000 14,000,000 2024 15,000,000 Cost of Goods Sold 5,000,000 6,000,000 7,000,000 7,500,000 Gross Profit Selling and Distribution 5,000,000 6,000,000 7,000,000 7,500,000 Administrative 1,000,000 400,000 1,200,000 1,400,000 1,500,000 400,000 400,000 400,000 Depreciation Expense 2,000,000 2,000,000 2,000,000 2,000,000 Operating Income 1,600,000 2,400,000 3,200,000 3,600,000 Income Tax Expense 480,000 720,000 960,000 1,080,000 Net Profit 1,120,000 1,680,000 2,240,000 2,520,000 Required Annual Capital Investment 1,000,000 1,000,000 1,000,000 1,000,000 XYZ, an equity capital venture company, is considering infusing money to Unicap Company. Based on its assessment, cost of capital associated with this type of investment is at 10%. Unicap Company has going concern assumption with net cash flows expected to grow by 5%. In addition to potential capital investment, Unicap Company has outstanding debt of P10,000,000. What is the net cash flow to the firm of Unicap Company? a. Php70,958,800 b. Php59,468,971 c. Php54,879,120 a. Php50,488,355 25. Refer to Unicap Company. If XYZ Company is buying 20% of Unicap Company, what is the reasonable price that they should pay? a. Php49,468,971 b. Php17,096,000 c. Php11,893,794 d. Php9,893,794 146

Step by Step Solution

There are 3 Steps involved in it

Summary of Answers 25 1 Net Cash ... View full answer

Get step-by-step solutions from verified subject matter experts