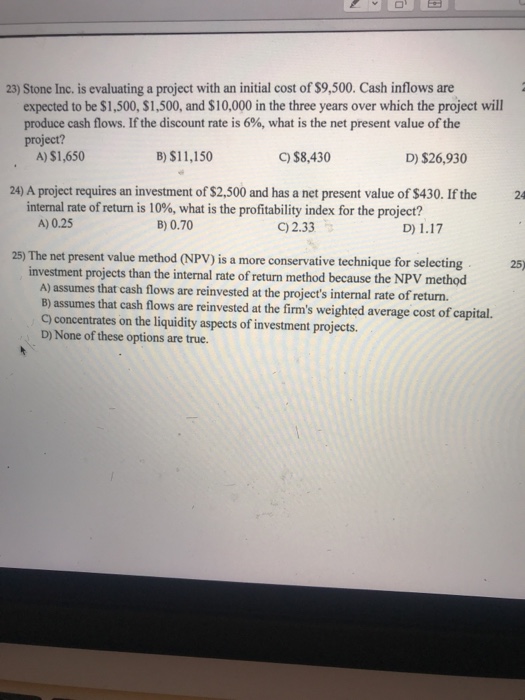

Question: 23) Stone Inc. is evaluating a project with an initial cost of S9,500. Cash inflows are expected to be $1,500, $1,500, and $10,000 in the

23) Stone Inc. is evaluating a project with an initial cost of S9,500. Cash inflows are expected to be $1,500, $1,500, and $10,000 in the three years over which the project will produce cash flows. If the discount rate is 6%, what is the net present value of the project? A) $1,650 B) $11,150 C) $8,430 D) $26,930 24) A project requires an investment of $2,500 and has a net present value of $430. If the 24 internal rte of return is 10%, what is the profitability index for the project? A) 0.25 B) 0.70 C) 2.33 D) 1.17 25) The net present value method (NPV) is a more conservative technique for selecting 25) investment projects than the internal rate of return method because the NPV method A) assumes that cash flows are reinvested at the project's internal rate of return. B) assumes that cash flows are reinvested at the firm's weighted average cost of capital. C) concentrates on the liquidity aspects of investment projects. D) None of these options are true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts