Question: 2:31 II '4' E} v. . - D' -w. .v-.-_.- w---.._.._. J -0 .. -.. a--. _ _.. ..-- v-..._y..-..-.-_. below in pro forma and

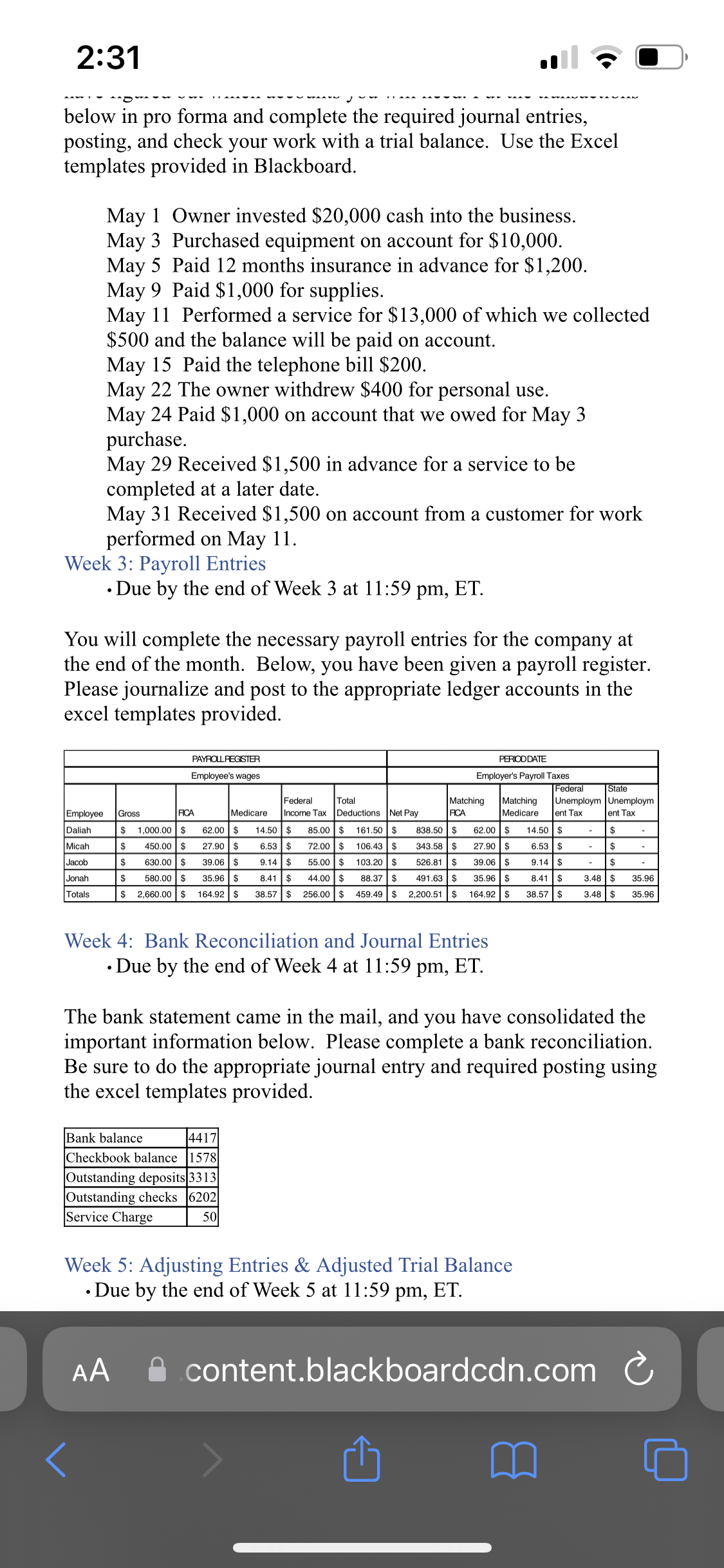

2:31 II '4' E} \"v. . - \"D""' -w. .v-.-_.- w---.._.._. J -0 .. -.. a--.\" _ _.. ..-- v-..._y..-..-.-_. below in pro forma and complete the required journal entries, posting, and check your work with a trial balance. Use the Excel templates provided in Blackboard. May 1 Owner invested $20,000 cash into the business. May 3 Purchased equipment on account for $10,000. May 5 Paid 12 months insurance in advance for $1,200. May 9 Paid $1,000 for supplies. May 11 Performed a service for $13,000 of which we collected $500 and the balance will be paid on account. May 15 Paid the telephone bill $200. May 22 The owner withdrew $400 for personal use. May 24 Paid $1 ,000 on account that we owed for May 3 purchase. May 29 Received $1,500 in advance for a service to be completed at a later date. May 31 Received $1,500 on account from a customer for work performed on May 11. Week 3: Payroll Entries - Due by the end of Week 3 at 11 :59 pm, ET. You will complete the necessary payroll entries for the company at the end of the month. Below, you have been given a payroll register. Please journalize and post to the appropriate ledger accounts in the excel templates provided, Fm) DATE Employee's wages Employer's Payroll Taxes metal .15 Federal Total Matching Matching Unamploym Unamplnym Medicare Income Tax Deductlans Net Pay FDA Medlcars Brit Tax 9111 Tax m_ 1 mm_ 5 8w 3906 $ 914 $ 5500 $ 10320 $ 52531 $ 39.05 $ 9.14 s - $ 35.56 $ 5.41 $ 44.00 $ 59.37 S 491.63 5 35.96 5 5.41 5 3.45 5 TEASE $ 3357 $ 25500 $ 45949 $ 2,200.51 $ 164.92 5 33.57 5 3.43 5 35.55 1,000.00 5 450 00 Jamb 5 630 00 Jonah 5 530.00 $ Week 4: Bank Reconciliation and Journal Entries - Due by the end of Week 4 at 11:59 pm, ET. The bank statement came in the mail, and you have consolidated the important information below. Please complete a bank reconciliation. Be sure to do the appropriate journal entry and required posting using the excel templates provided. Bank balance 4417 Checkbook balance E578 Outstanding deposits 33] 3 Outstanding checks 6202 Service Charge Week 5: Adjusting Entries & Adjusted Trial Balance -Due by the end of Week 5 at 11:59 pm, ET. AA 0 contentblackboardcdn.com C)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts