Question: 231883,ond Chapter 8. DO1 WEEK 6 HOMEWORK 2: CUSTOM (30 PTS) If you need help submiting assignments, please click here for more information There are

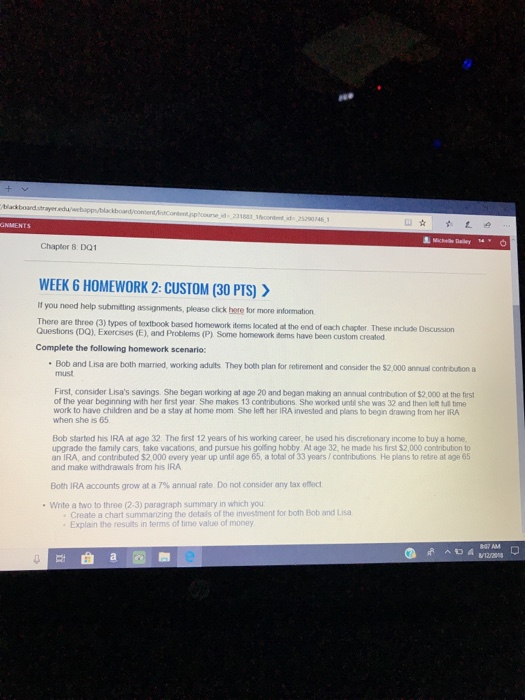

231883,ond Chapter 8. DO1 WEEK 6 HOMEWORK 2: CUSTOM (30 PTS) If you need help submiting assignments, please click here for more information There are three (3) types of textbook based homework items located at Questions (DQ), Exercises (E), and Problems (P) Some homework items have been custom created Complete the following homework scenario: 0 the end of each chapter. These include Discussion Bob and Lisa are both married, working adults They both plan for retirement and consider the $2,000 annual contribution a must First, consider Lisa's savings. She began working at age 20 and began making an annual contribution of $2,000 at the first of the year beginning with her first year She makes 13 contributions. She worked until she was 32 and then let tull time work to have children and be a stay at home mom She left her IRA invested and plians to begin drawing from her iRA when she is 65 Bob started his IRA at age 32 The first 12 years of his working career, he used his discretionary income to buy a home, upgrade the family cars, take vacations, and pursue his gollting hobby At age 32, he made his first $2,000 contribution to an IRA, and contributed $2,000 every year up until age 65, a total of 33 years/contrbutions. He plans to retire at age 65 and make withdrawals from his IRA Both IRA accounts grow at a 7% annual rate Dont consider any tax end Write a two to three (2-3) paragraph summary in which you Create a chart summarizing the detals of the investment for both Bob and Lisa Explain the results in terms of time value of money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts