Question: 2,3,5 please QUESTION 2 You purchase to settle July 4, 2023 a $11,000 semi-annual 12.250% bond issued November 4, 2015 and maturing November 4, 2034.

2,3,5 please

2,3,5 please

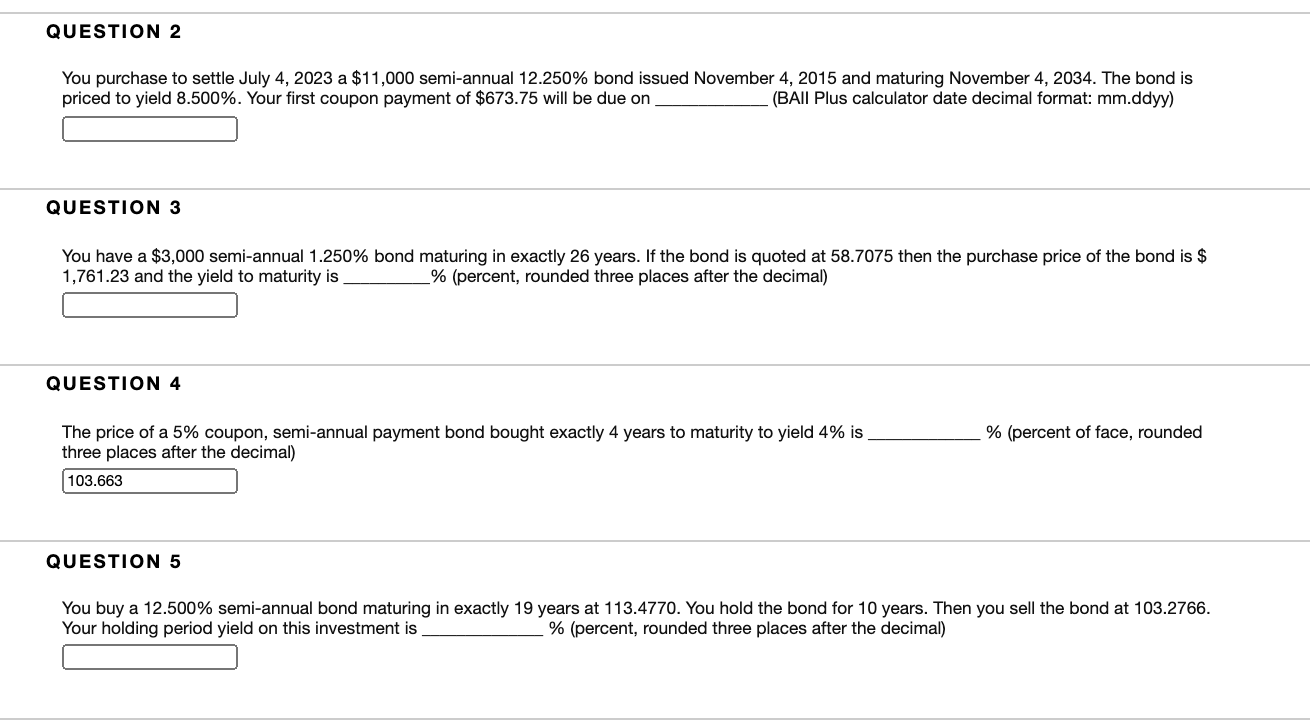

QUESTION 2 You purchase to settle July 4, 2023 a $11,000 semi-annual 12.250% bond issued November 4, 2015 and maturing November 4, 2034. The bond is priced to yield 8.500%. Your first coupon payment of $673.75 will be due on (BAll Plus calculator date decimal format: mm.ddyy) QUESTION 3 You have a $3,000 semi-annual 1.250% bond maturing in exactly 26 years. If the bond is quoted at 58.7075 then the purchase price of the bond is $ 1,761.23 and the yield to maturity is % (percent, rounded three places after the decimal) QUESTION 4 % (percent of face, rounded The price of a 5% coupon, semi-annual payment bond bought exactly 4 years to maturity to yield 4% is three places after the decimal) 103.663 QUESTION 5 You buy a 12.500% semi-annual bond maturing in exactly 19 years at 113.4770. You hold the bond for 10 years. Then you sell the bond at 103.2766. Your holding period yield on this investment is % (percent, rounded three places after the decimal) QUESTION 2 You purchase to settle July 4, 2023 a $11,000 semi-annual 12.250% bond issued November 4, 2015 and maturing November 4, 2034. The bond is priced to yield 8.500%. Your first coupon payment of $673.75 will be due on (BAll Plus calculator date decimal format: mm.ddyy) QUESTION 3 You have a $3,000 semi-annual 1.250% bond maturing in exactly 26 years. If the bond is quoted at 58.7075 then the purchase price of the bond is $ 1,761.23 and the yield to maturity is % (percent, rounded three places after the decimal) QUESTION 4 % (percent of face, rounded The price of a 5% coupon, semi-annual payment bond bought exactly 4 years to maturity to yield 4% is three places after the decimal) 103.663 QUESTION 5 You buy a 12.500% semi-annual bond maturing in exactly 19 years at 113.4770. You hold the bond for 10 years. Then you sell the bond at 103.2766. Your holding period yield on this investment is % (percent, rounded three places after the decimal)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts