Question: 236 Chapter 5 Loan repayment 5.6 PROBLEMS, CHAPTER 5 (5.0) Chapter 5 writing problems (I) For calendar year 2004, the Johnsons are eligible to claim

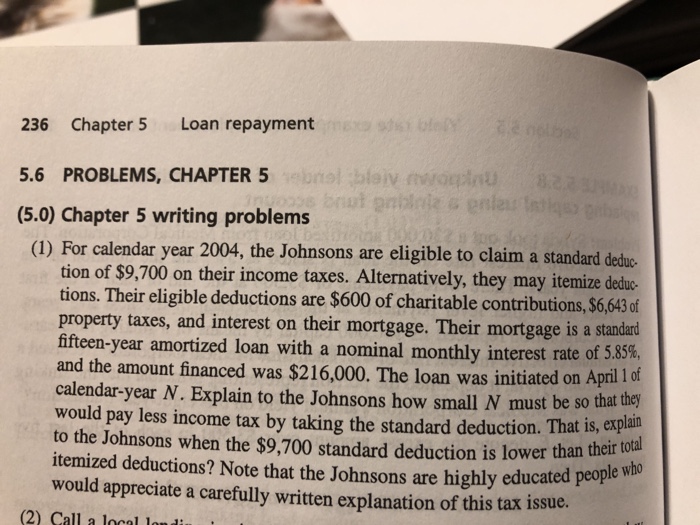

236 Chapter 5 Loan repayment 5.6 PROBLEMS, CHAPTER 5 (5.0) Chapter 5 writing problems (I) For calendar year 2004, the Johnsons are eligible to claim a standard deduc tion of $9,700 on their income taxes. Alternatively, they may itemize deduc- tions. Their eligible deductions are $600 of charitable contributions, $6,643 of property taxes, and interest on their mortgage. Their mortgage is a standard fifteen-year amortized loan with a nominal monthly interest rate of 5.85% and the amount financed was $216,000. The loan was initiated on April calendar-year N. Explain to the Johnsons how small N must be so that would pay less income tax by taking the standard deduction. That is, expla to the Johnsons when the $9,700 standard deduction is lower than their itemized deductions? Note that the Johnsons are highly educated peope would appreciate a carefully written explanation of this tax issue. 1 of they who (2) Call a Iocal londiu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts