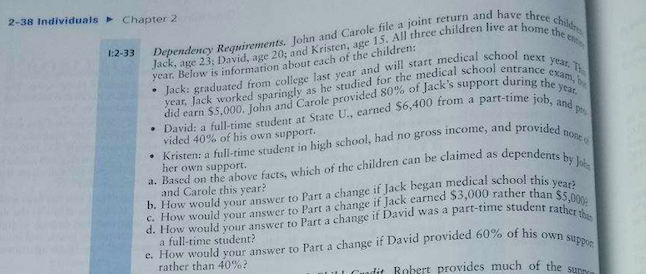

Question: 2-38 Individuals Chapter 2 Jack, age 23; David, age 20; and Kristen, age 15. All three children live at home the e Jack: graduated from

2-38 Individuals Chapter 2 Jack, age 23; David, age 20; and Kristen, age 15. All three children live at home the e Jack: graduated from college last year and will start medical school next yeat. T did earn $5,000. John and Carole provided 80% of Jack's support during the year. Dependency Requirements. John and Carole file a joint return and have three childr 1:2-33 year. Below is information about each of the children: as he studied for the mnedical school entrance exam, b year, Jack worked sparingly David: a full-time student at State U., carned $6,400 from a part-time job, and Kristen: a full-time student in high school, had no gross income, and provided r her own support. a. Based on the above facts, which of the children can be claimed as and Carole this year? b. How would your answer to Part a change if Jack began medical school this year? c. How would your answer to Part a change if Jack earned $3,000 rather than $5,000 d. How would your answer to Part a change if David was a a full-time student? vided 40% of his own support. noneo dependents by J part-time student rather e. How would your answer to Part a change if David provided 60 % of his own suppor rather than 40% LL Cuadit Robert provides much of the supra

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts