Question: 2-4 2. From 1926 to the present a. b. c. d. e. Asset classes with the lowest returns were the most risky Asset classes with

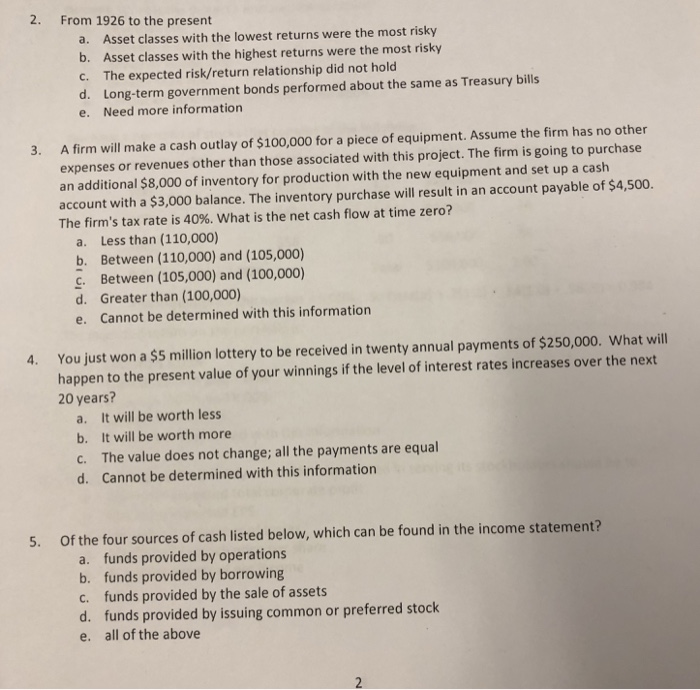

2. From 1926 to the present a. b. c. d. e. Asset classes with the lowest returns were the most risky Asset classes with the highest returns were the most risky The expected risk/return relationship did not hold Long-term government bonds performed about the same as Treasury bills Need more information 3. A firm will make a cash outlay of $100,000 for a piece of equipment. Assume the firm has no other expenses or revenues other than those associated with this project. The firm is going to purchase an additional $8,000 of inventory for production with the new equipment and set up a cash account with a $3,000 balance. The inventory purchase will result in an account payable of $4,500. The firm's tax rate is 40%, what is the net cash flow at time zero? a. Less than (110,000) b. Between (110,000) and (105,000) c Between (105,000) and (100,000) d. Greater than (100,000) e. Cannot be determined with this information 4. You just won a $5 million lottery to be received in twenty annual payments of $250,000. What will happen to the present value of your winnings if the level of interest rates increases over the next 20 years? a. It will be worth less b. It will be worth more c. The value does not change; all the payments are equal d. Cannot be determined with this information 5. Of the four sources of cash listed below, which can be found in the income statement? a. funds provided by operations b. funds provided by borrowing c. funds provided by the sale of assets d. funds provided by issuing common or preferred stock e. all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts