Question: 24 Lacey is developing material and labor standards for her company. She finds that it costs $0.32 per pound of material per widget. Each widget

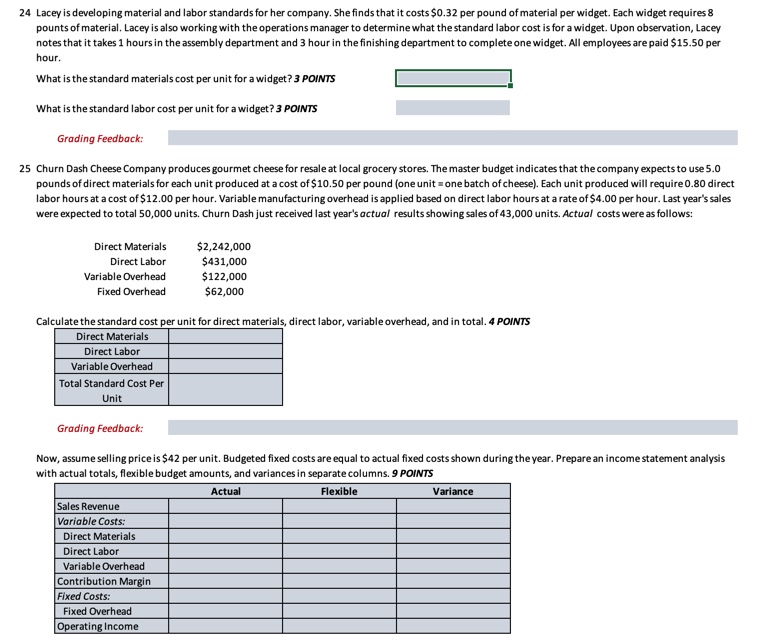

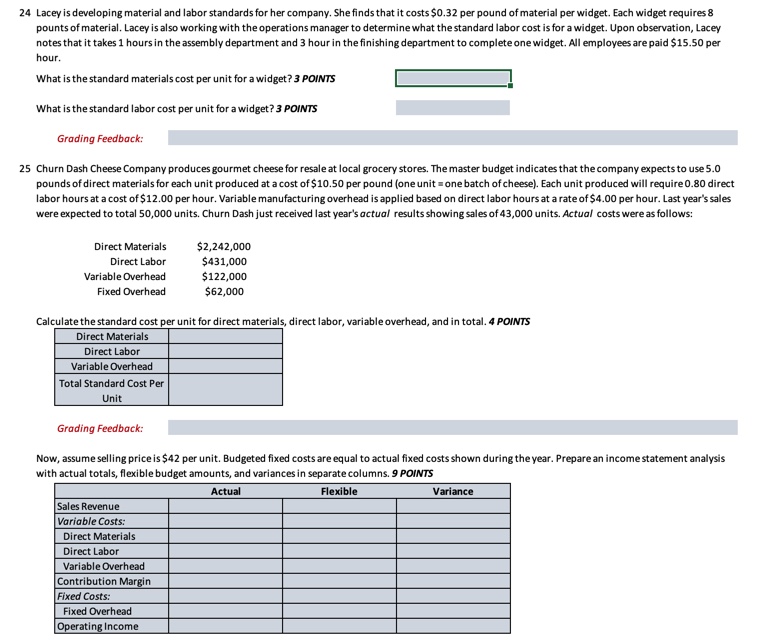

24 Lacey is developing material and labor standards for her company. She finds that it costs $0.32 per pound of material per widget. Each widget requires & pounts of material. Lacey is also working with the operations manager to determine what the standard labor cost is for a widget. Upon observation, Lacey notes that it takes 1 hours in the assembly department and 3 hour in the finishing department to complete one widget. All employees are paid $15.50 per hour. What is the standard materials cost per unit for a widget? 3 POINTS What is the standard labor cost per unit for a widget? 3 POINTS Grading Feedback: 25 Churn Dash Cheese Company produces gourmet cheese for resale at local grocery stores. The master budget indicates that the company expects to use 5.0 pounds of direct materials for each unit produced at a cost of $10.50 per pound (one unit = one batch of cheese). Each unit produced will require 0.80 direct labor hours at a cost of $12.00 per hour. Variable manufacturing overhead is applied based on direct labor hours at a rate of $4.00 per hour. Last year's sales were expected to total 50,000 units. Churn Dash just received last year's actual results showing sales of 43,000 units. Actual costs were as follows: Direct Materials $2,242,000 Direct Labor $431,000 Variable Overhead $122,000 Fixed Overhead $62,000 Calculate the standard cost per unit for direct materials, direct labor, variable overhead, and in total. 4 POINTS Direct Materials Direct Labor Variable Overhead Total Standard Cost Per Unit Grading Feedback: Now, assume selling price is $42 per unit. Budgeted fixed costs are equal to actual fixed costs shown during the year. Prepare an income statement analysis with actual totals, flexible budget amounts, and variances in separate columns. 9 POINTS Actual Flexible Variance Sales Revenue Variable Costs: Direct Materials Direct Labor Variable Overhead Contribution Margin Fixed Costs: Fixed Overhead Operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts