Question: 24 Problem 6-17 Bond Returns (LO02, 3) 10 points A bond with a face value of $1,000 has 10 years until maturity, carries a coupon

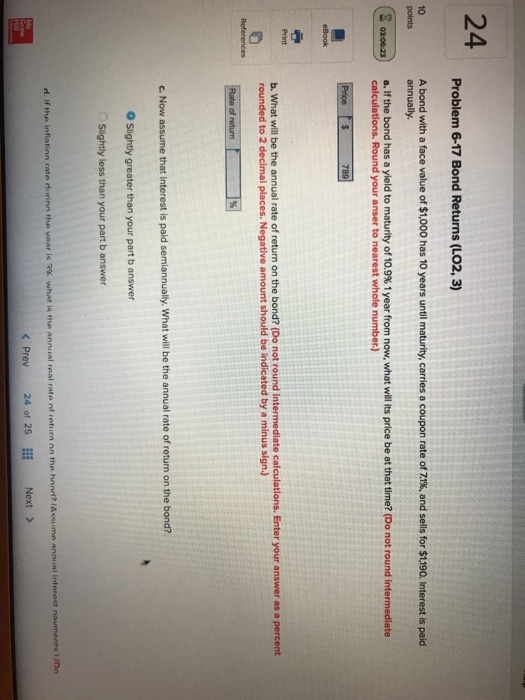

24 Problem 6-17 Bond Returns (LO02, 3) 10 points A bond with a face value of $1,000 has 10 years until maturity, carries a coupon rte of 71%, and sells for $1,190. Interest is paid annually. a. If the bond has a yield to maturity of 10.9% 1 year from now, what will its price be at that time? Do not round intermediate calculations. Round your anser to nearest whole number) 030023, rounded to 2 decimal places. Negative amount should be indicated by a minus sign.) c. Now assume that interest is paid semiannually. What will be the annual rate of return on the bond? O Slightly greater than your part b answer d if the inf ation rate durina the ear ie 3% what k the anni lal real rate nf return nn the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts