Question: 24. Stock X has an expected return 5 pc of 12 percent, a beta of 1.2, and a standard deviation of 20 percent. Stock Y

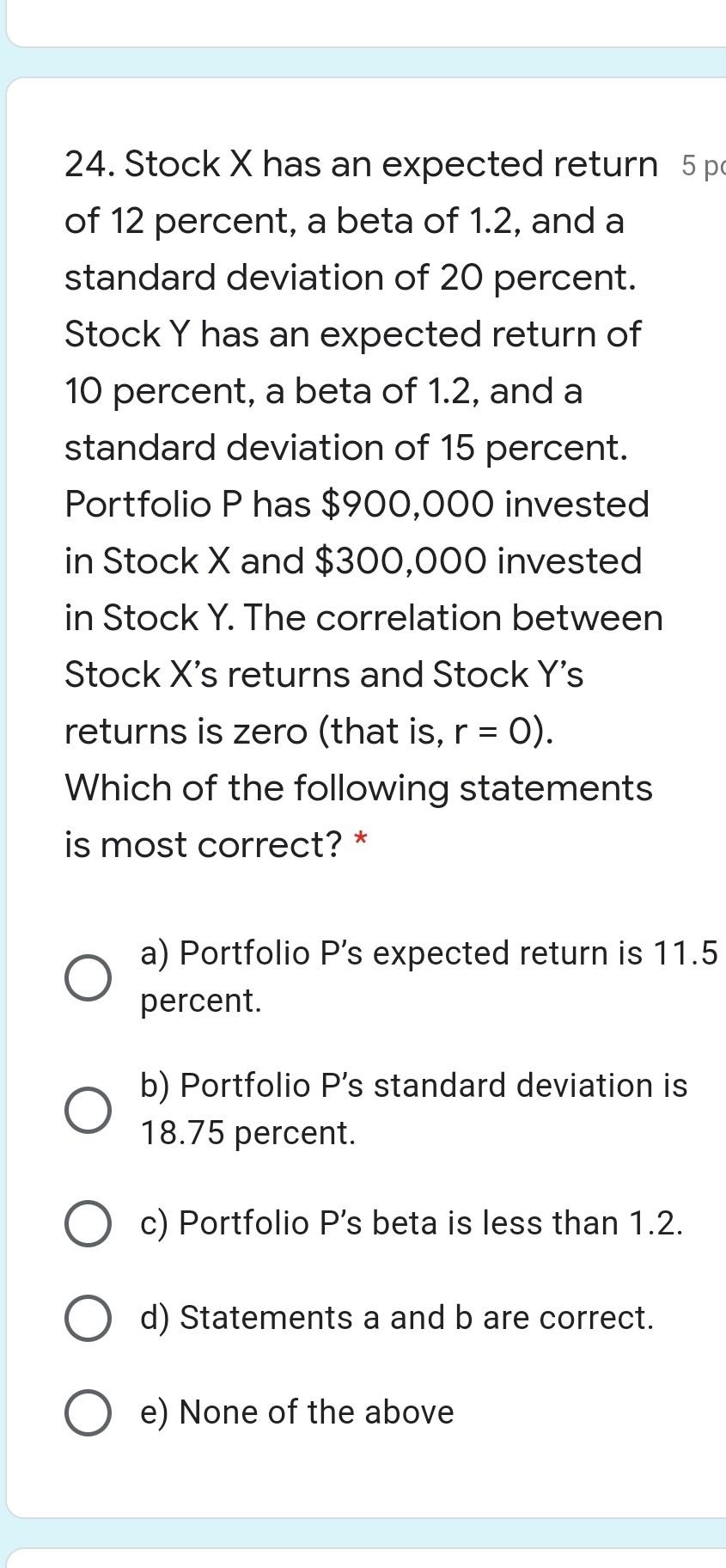

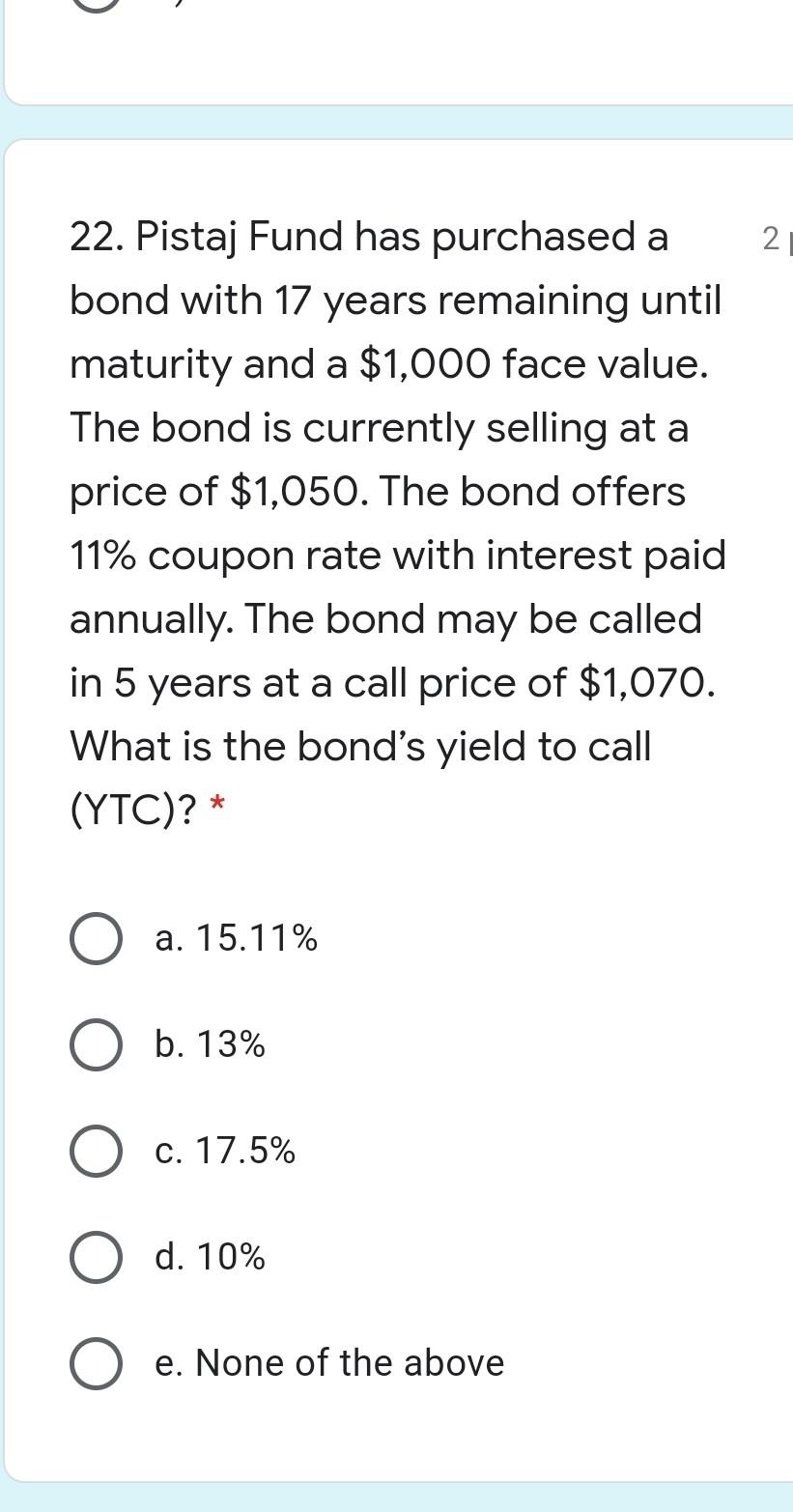

24. Stock X has an expected return 5 pc of 12 percent, a beta of 1.2, and a standard deviation of 20 percent. Stock Y has an expected return of 10 percent, a beta of 1.2, and a standard deviation of 15 percent. Portfolio P has $900,000 invested in Stock X and $300,000 invested in Stock Y. The correlation between Stock X's returns and Stock Y's returns is zero (that is, r = 0). Which of the following statements is most correct? * a) Portfolio P's expected return is 11.5 percent. b) Portfolio P's standard deviation is 18.75 percent. c) Portfolio P's beta is less than 1.2. d) Statements a and b are correct. e) None of the above 2 22. Pistaj Fund has purchased a bond with 17 years remaining until maturity and a $1,000 face value. The bond is currently selling at a price of $1,050. The bond offers 11% coupon rate with interest paid annually. The bond may be called in 5 years at a call price of $1,070. What is the bond's yield to call (YTC)? * a. 15.11% b. 13% c. 17.5% d. 10% e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts