Question: 24. There are only two assets in the world, one risky asset and one risk-free asset. The expected return of the risky asset is 800

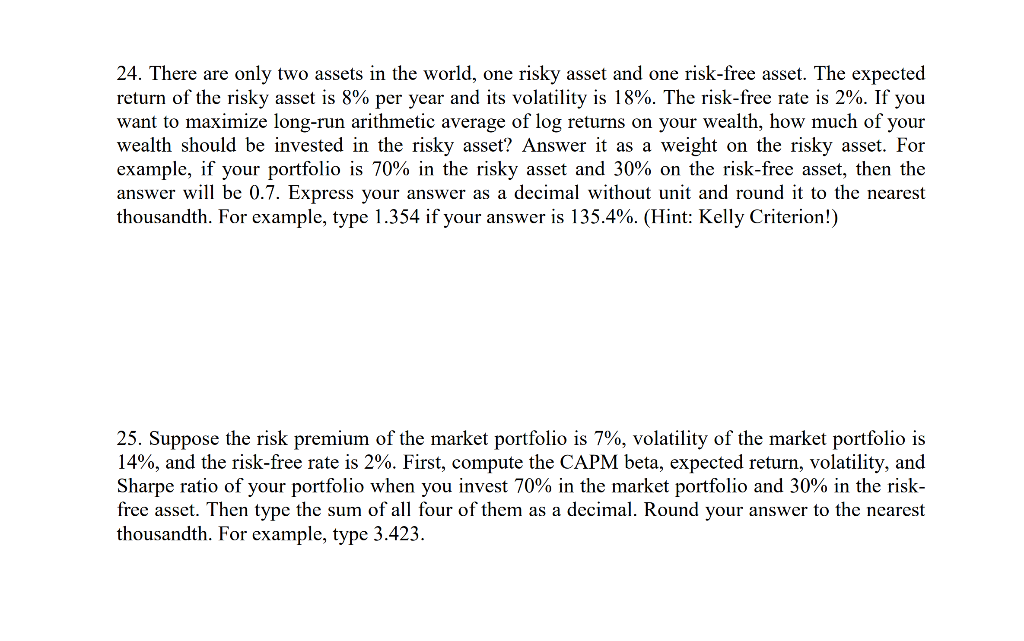

24. There are only two assets in the world, one risky asset and one risk-free asset. The expected return of the risky asset is 800 per year and its volatility is 18%. The risk-free rate is 2%. If you want to maximize long-run arithmetic average of log returns on your wealth, how much of your wealth should be invested in the risky asset? Answer it as a weight on the risky asset. For example, if your portfolio is 70% in the risky asset and 30% on the risk-free asset, then the answer will be 0.7. Express your answer as a decimal without unit and round it to the nearest thousandth. For example, type 1.354 if your answer is l 35.4%. (Hint: Kelly Criterion!) 25 Suppose the risk premium of the market portfolio is 7%, volatility of the market portfolio is 1400, and the risk-free rate is 2%. First, compute the CAPM beta, expected return, volatility, and Sharpe ratio of your portfolio when you invest 70% in the market portfolio and 30% in the risk- free asset. Then type the sum of all four of them as a decimal. Round your answer to the nearest thousandth. For example, type 3.423. 24. There are only two assets in the world, one risky asset and one risk-free asset. The expected return of the risky asset is 800 per year and its volatility is 18%. The risk-free rate is 2%. If you want to maximize long-run arithmetic average of log returns on your wealth, how much of your wealth should be invested in the risky asset? Answer it as a weight on the risky asset. For example, if your portfolio is 70% in the risky asset and 30% on the risk-free asset, then the answer will be 0.7. Express your answer as a decimal without unit and round it to the nearest thousandth. For example, type 1.354 if your answer is l 35.4%. (Hint: Kelly Criterion!) 25 Suppose the risk premium of the market portfolio is 7%, volatility of the market portfolio is 1400, and the risk-free rate is 2%. First, compute the CAPM beta, expected return, volatility, and Sharpe ratio of your portfolio when you invest 70% in the market portfolio and 30% in the risk- free asset. Then type the sum of all four of them as a decimal. Round your answer to the nearest thousandth. For example, type 3.423

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts