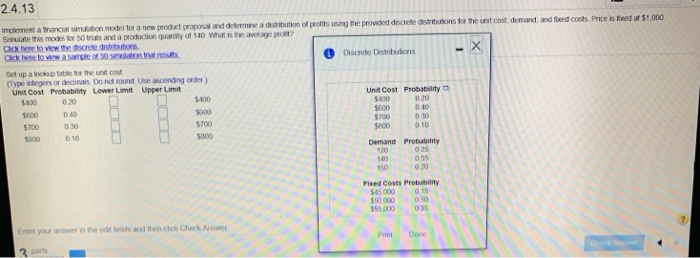

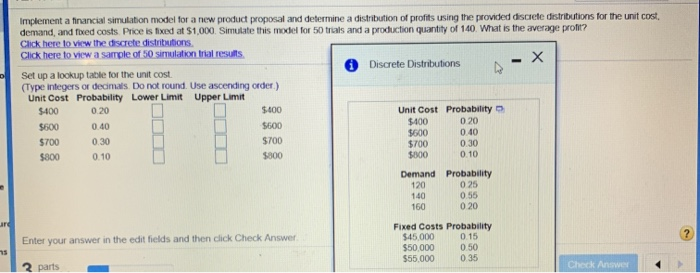

Question: 2.4.13 Implement a tnancial simuaton model for a new product proposual and detemine a distribution of peofits using the provided dscrete dtrituions for the unit

2.4.13 Implement a tnancial simuaton model for a new product proposual and detemine a distribution of peofits using the provided dscrete dtrituions for the unit cost, demand, and foxed costs Price is fxed at $1.000 Smulate this model tor 50 tras and a production quardty of 140 What s the average proft? Clck here to view the dscrete drstrbutons Cick here to view a sample of 30 smdaton trial resuts Discrete Distributons Set up a lockap table tor the unt cost (Type integers or deamals Do not sound Use ancendng order) Unit Cost Probability Lower Limit Upper Limit Unit Cost Probability 0 20 0.40 0 30 0.10 $400 S400 S600 $700 S800 020 S600 S600 0.40 $700 0.30 S700 $800 0.10 S800 Demand Probabitity 025 055 020 120 140 150 Fixed Costs Probability 0.15 0 50 035 $45 000 $50000 $55,000 Enter your answer in the edt elds and then clck Check Anower Done Print 2 parts Implement a financial simulation model for a new product proposal and determine a distribution of profits using the provided dscrete dstributions for the unit cost. demand, and fixed costs Price is fixed at $1,000. Simulate this model for 50 trials and a production quantity of 140. What is the average proft? Click here to view the discrete distributions Click here to view a sample of 50 simulation trial results - X Discrete Distributions Set up a lookup table for the unit cost (Type integers or decimals Do not round. Use ascending order) Unit Cost Probability Lower Limit Upper Limit Unit Cost Probability $400 $400 0.20 0 20 $400 $600 $700 $800 $600 $600 0.40 0.40 $700 $700 0.30 0.30 0.10 $800 $800 0.10 Demand Probability 120 140 0 25 0.55 0 20 160 Fixed Costs Probability $45.000 7 0.15 Enter your answer in the edit fields and then click Check Answer $50.000 0.50 0.35 hs $55,000 Check Answer parts 2.4.13 Implement a tnancial simuaton model for a new product proposual and detemine a distribution of peofits using the provided dscrete dtrituions for the unit cost, demand, and foxed costs Price is fxed at $1.000 Smulate this model tor 50 tras and a production quardty of 140 What s the average proft? Clck here to view the dscrete drstrbutons Cick here to view a sample of 30 smdaton trial resuts Discrete Distributons Set up a lockap table tor the unt cost (Type integers or deamals Do not sound Use ancendng order) Unit Cost Probability Lower Limit Upper Limit Unit Cost Probability 0 20 0.40 0 30 0.10 $400 S400 S600 $700 S800 020 S600 S600 0.40 $700 0.30 S700 $800 0.10 S800 Demand Probabitity 025 055 020 120 140 150 Fixed Costs Probability 0.15 0 50 035 $45 000 $50000 $55,000 Enter your answer in the edt elds and then clck Check Anower Done Print 2 parts Implement a financial simulation model for a new product proposal and determine a distribution of profits using the provided dscrete dstributions for the unit cost. demand, and fixed costs Price is fixed at $1,000. Simulate this model for 50 trials and a production quantity of 140. What is the average proft? Click here to view the discrete distributions Click here to view a sample of 50 simulation trial results - X Discrete Distributions Set up a lookup table for the unit cost (Type integers or decimals Do not round. Use ascending order) Unit Cost Probability Lower Limit Upper Limit Unit Cost Probability $400 $400 0.20 0 20 $400 $600 $700 $800 $600 $600 0.40 0.40 $700 $700 0.30 0.30 0.10 $800 $800 0.10 Demand Probability 120 140 0 25 0.55 0 20 160 Fixed Costs Probability $45.000 7 0.15 Enter your answer in the edit fields and then click Check Answer $50.000 0.50 0.35 hs $55,000 Check Answer parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts