Question: $24,734 is wrong please help me solve the whole question. . Manchester Clinic, a nonprofit organization, estimates that it can savo $26,000 a yoar in

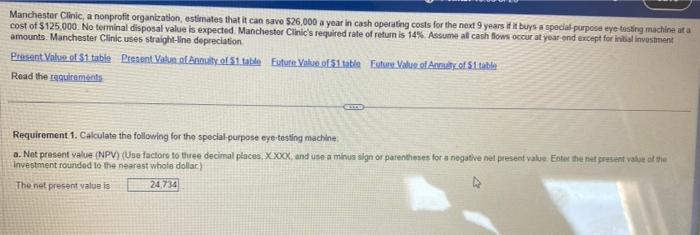

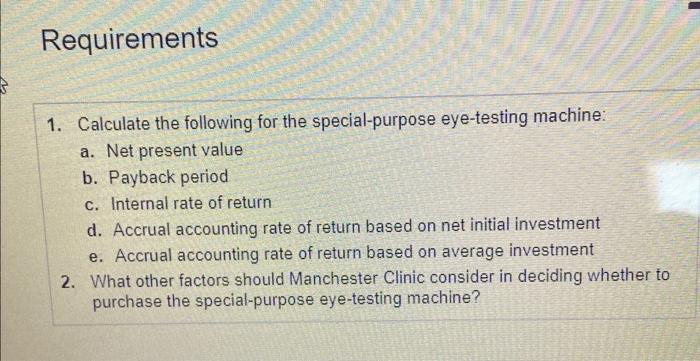

Manchester Clinic, a nonprofit organization, estimates that it can savo $26,000 a yoar in cash operating costs for the next 9 years if it buys a speciaf-purpese eye tossing machine at a cost of $125,000. No terminal disposal value is expected. Manchester CTinic's required rate of return is 14%. Assume all cash flows occur at year end except for initial livestrinent amounts. Manchester Clinic uses straight-line depreciation Road the reguicements Requirement 1. Calculate the following for the speclal-purpose eye-testing machine: investment rounded to the nearest whole dollar? The net present value is Requirements 1. Calculate the following for the special-purpose eye-testing machine: a. Net present value b. Payback period c. Internal rate of return d. Accrual accounting rate of return based on net initial investment e. Accrual accounting rate of return based on average investment 2. What other factors should Manchester Clinic consider in deciding whether to purchase the special-purpose eye-testing machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts