Question: || 25. (10) Please hand-write your answer and take photo to upload) [Problem Solving] Please give details on how to solve the problem, step by

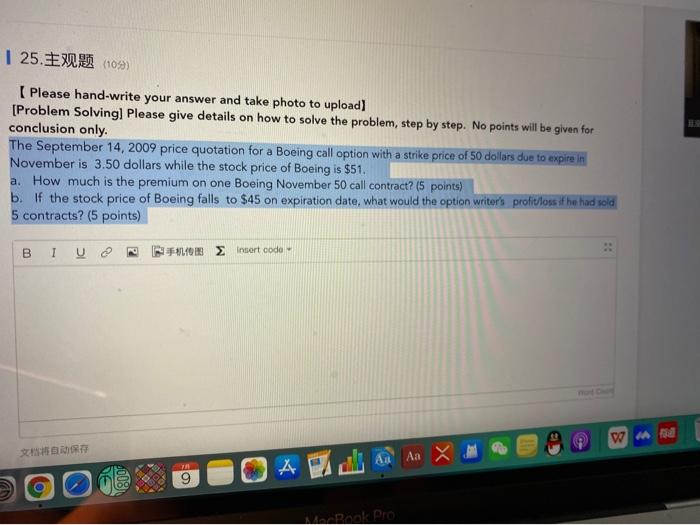

|| 25. (10) Please hand-write your answer and take photo to upload) [Problem Solving] Please give details on how to solve the problem, step by step. No points will be given for conclusion only. The September 14, 2009 price quotation for a Boeing call option with a strike price of 50 dollars due to expire in November is 3.50 dollars while the stock price of Boeing is $51. a. How much is the premium on one Boeing November 50 call contract? (5 points) b. If the stock price of Boeing falls to $45 on expiration date, what would the option writer's profit loss if he had sold 5 contracts? (5 points) 110 insert code WA AN 4 An X 0) Book Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts