Question: 25. Assuming that a segment has both Variable Expenses and Traceable Fixed Expenses, an increase in Sales should increase Profits by an amount equal to

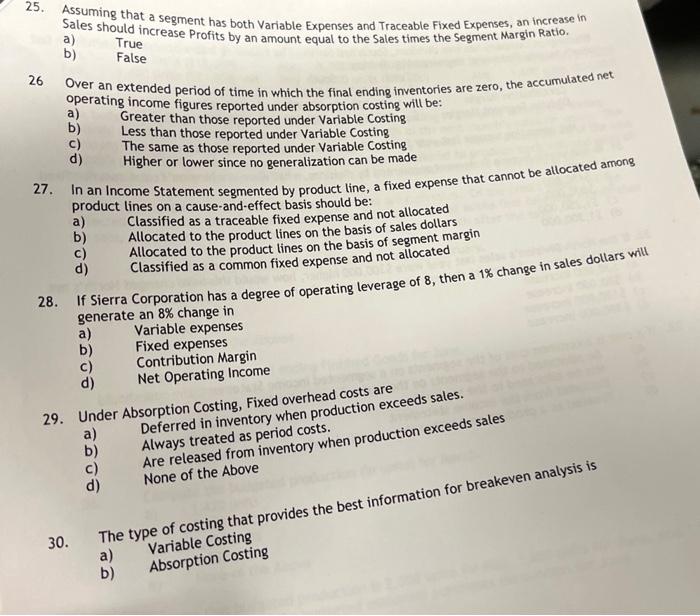

25. Assuming that a segment has both Variable Expenses and Traceable Fixed Expenses, an increase in Sales should increase Profits by an amount equal to the Sales times the Segment Margin Ratio. a) True b) False 26 Over an extended period of time in which the final ending inventories are zero, the accumulated net operating income figures reported under absorption costing will be: a) Greater than those reported under Variable Costing b) Less than those reported under Variable costing c) The same as those reported under Variable Costing d) Higher or lower since no generalization can be made 27. In an Income Statement segmented by product line, a fixed expense that cannot be allocated amons product lines on a cause-and-effect basis should be: a) Classified as a traceable fixed expense and not allocated b) Allocated to the product lines on the basis of sales dollars c) Allocated to the product lines on the basis of segment margin d) Classified as a common fixed expense and not allocated 28. If Sierra Corporation has a degree of operating leverage of 8 , then a 1% change in sales dollars will generate an 8% change in a) Variable expenses b) Fixed expenses c) Contribution Margin d) Net Operating Income 29. Under Absorption Costing, Fixed overhead costs are a) Deferred in inventory when production exceeds sales. b) Always treated as period costs. c) Are released from inventory when production exceeds sales d) None of the Above a) Variable Costing b) Absorption Costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts