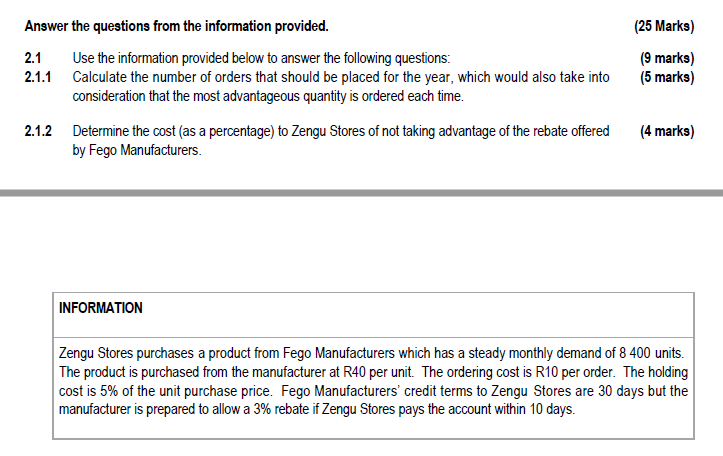

Question: (25 Marks) (9 marks) (5 marks) Answer the questions from the information provided. 2.1 Use the information provided below to answer the following questions: 2.1.1

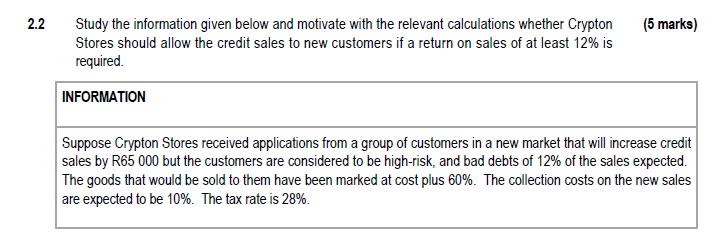

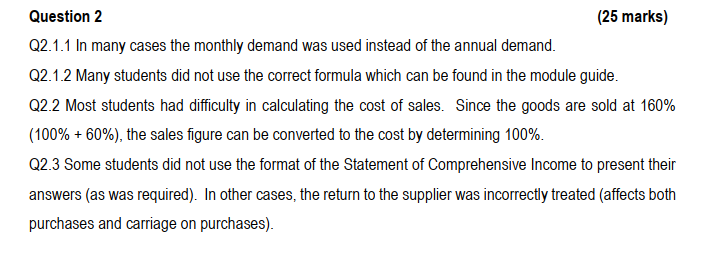

(25 Marks) (9 marks) (5 marks) Answer the questions from the information provided. 2.1 Use the information provided below to answer the following questions: 2.1.1 Calculate the number of orders that should be placed for the year, which would also take into consideration that the most advantageous quantity is ordered each time. 2.1.2 Determine the cost (as a percentage) to Zengu Stores of not taking advantage of the rebate offered by Fego Manufacturers. (4 marks) INFORMATION Zengu Stores purchases a product from Fego Manufacturers which has a steady monthly demand of 8 400 units. The product is purchased from the manufacturer at R40 per unit. The ordering cost is R10 per order. The holding cost is 5% of the unit purchase price. Fego Manufacturers' credit terms to Zengu Stores are 30 days but the manufacturer is prepared to allow a 3% rebate if Zengu Stores pays the account within 10 days. 2.2 (5 marks) Study the information given below and motivate with the relevant calculations whether Crypton Stores should allow the credit sales to new customers if a return on sales of at least 12% is required. INFORMATION Suppose Crypton Stores received applications from a group of customers in a new market that will increase credit sales by R65 000 but the customers are considered to be high-risk, and bad debts of 12% of the sales expected. The goods that would be sold to them have been marked at cost plus 60%. The collection costs on the new sales are expected to be 10%. The tax rate is 28%. Question 2 (25 marks) Q2.1.1 In many cases the monthly demand was used instead of the annual demand. Q2.1.2 Many students did not use the correct formula which can be found in the module guide. Q2.2 Most students had difficulty in calculating the cost of sales. Since the goods are sold at 160% (100% + 60%), the sales figure can be converted to the cost by determining 100%. Q2.3 Some students did not use the format of the Statement of Comprehensive Income to present their answers (as was required). In other cases, the return to the supplier was incorrectly treated (affects both purchases and carriage on purchases)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts