Question: 25. Problem 10.33 (Applying the Value-at-Risk Method) Algo eBook You use today's spot rate of the Brazilian real to forecast the spot rate of the

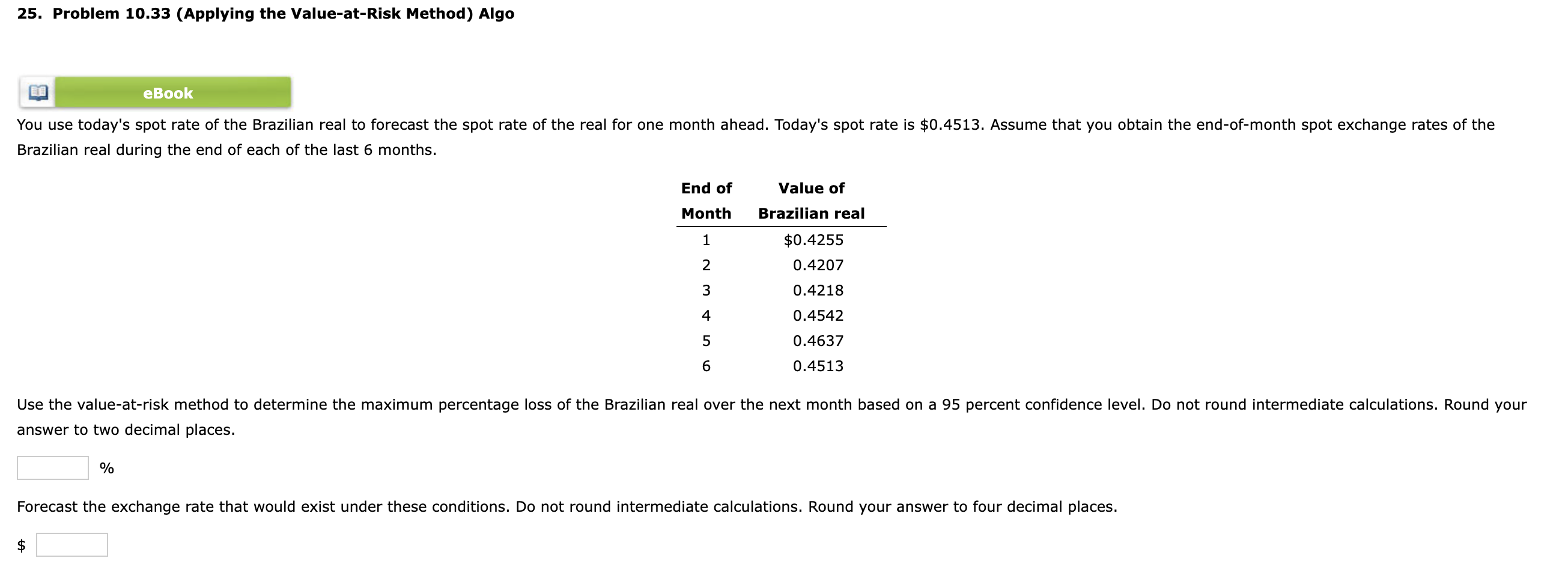

25. Problem 10.33 (Applying the Value-at-Risk Method) Algo eBook You use today's spot rate of the Brazilian real to forecast the spot rate of the real for one month ahead. Today's spot rate is $0.4513. Assume that you obtain the end-of-month spot exchange rates of the Brazilian real during the end of each of the last 6 months. End of Value of Month Brazilian real 1 $0.4255 0.4207 2 3 0.4218 4 0.4542 5 0.4637 6 0.4513 Use the value-at-risk method to determine the maximum percentage loss of the Brazilian real over the next month based on a 95 percent confidence level. Do not round intermediate calculations. Round your answer to two decimal places. % Forecast the exchange rate that would exist under these conditions. Do not round intermediate calculations. Round your answer to four decimal places. $ 25. Problem 10.33 (Applying the Value-at-Risk Method) Algo eBook You use today's spot rate of the Brazilian real to forecast the spot rate of the real for one month ahead. Today's spot rate is $0.4513. Assume that you obtain the end-of-month spot exchange rates of the Brazilian real during the end of each of the last 6 months. End of Value of Month Brazilian real 1 $0.4255 0.4207 2 3 0.4218 4 0.4542 5 0.4637 6 0.4513 Use the value-at-risk method to determine the maximum percentage loss of the Brazilian real over the next month based on a 95 percent confidence level. Do not round intermediate calculations. Round your answer to two decimal places. % Forecast the exchange rate that would exist under these conditions. Do not round intermediate calculations. Round your answer to four decimal places. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts