Question: (25) QUESTION 3 REQUIRED Use the information provided below to answer the following questions. Express the answers to the ratios to two decimal places. 3.1

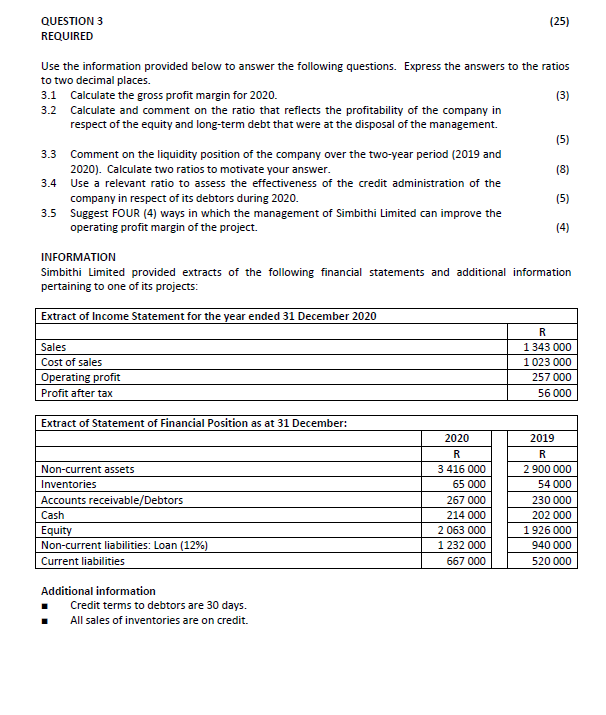

(25) QUESTION 3 REQUIRED Use the information provided below to answer the following questions. Express the answers to the ratios to two decimal places. 3.1 Calculate the gross profit margin for 2020. (3) 3.2 Calculate and comment on the ratio that reflects the profitability of the company in respect of the equity and long-term debt that were at the disposal of the management. (5) 3.3 Comment on the liquidity position of the company over the two-year period (2019 and 2020). Calculate two ratios to motivate your answer. (8) 3.4 Use a relevant ratio to assess the effectiveness of the credit administration of the company in respect of its debtors during 2020. (5) 3.5 Suggest FOUR (4) ways in which the management of Simbithi Limited can improve the operating profit margin of the project. (4) INFORMATION Simbithi Limited provided extracts of the following financial statements and additional information pertaining to one of its projects: Extract of Income Statement for the year ended 31 December 2020 Sales Cost of sales Operating profit Profit after tax R 1 343 000 1023 000 257 000 56 000 Extract of Statement of Financial Position as at 31 December: 2020 Non-current assets Inventories Accounts receivable/Debtors Cash Equity Non-current liabilities: Loan (12%) Current liabilities R 3 416 000 65 000 267 000 214 000 2 063 000 1 232 000 667 000 2019 R 2 900 000 54 000 230 000 202 000 1 926 000 940 000 520 000 Additional information Credit terms to debtors are 30 days. All sales of inventories are on credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts