Question: 25. The ABC approsch to inventory mansgement is based on t inventory b, the inventory t the time it is needed in e a e.

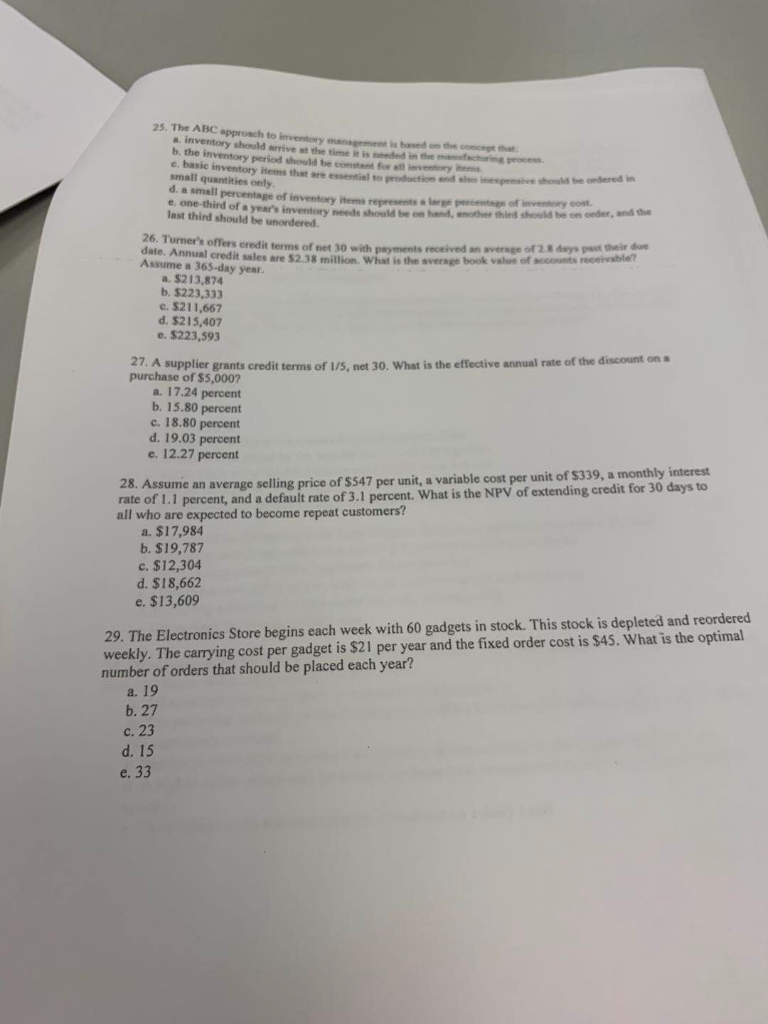

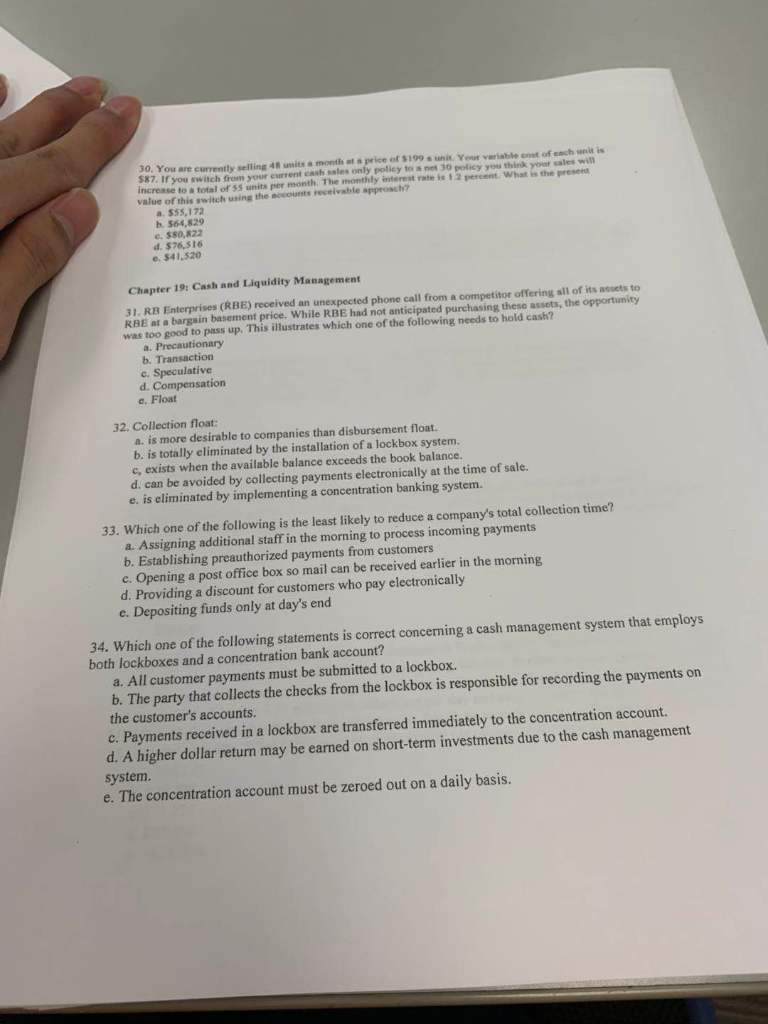

25. The ABC approsch to inventory mansgement is based on t inventory b, the inventory t the time it is needed in e a e. basic inventory items that ere essential to production and slso inexpensive should be ondered in ng process be constent for all inventory ihems d.a s es only e, one-thind of f inventory items represents a lerge percentege of inventory cost last third should be unondered. y needs should be on hand, another third should be on order, and the 26. Turmer's date. Annus credit terms Assume a 365-day vear a. $213,874 b. $223,333 $211,667 5,407 e. $223,593 f net 30 with payments received an aversge of 2.8 days past their due are $2.38 million. What is the average book value of sccounts receivable? 27. A supplier grants credit terms of 1/5, net 30. What is the effective annual rate of the discount on a purchase of $5,000? a. 17.24 percent b. 15.80 percent c. 18.80 percent d. 19.03 percent e. 12.27 percent 28. Assume an average selling price of $547 per unit, a variable cost per unit of $339, a monthly interest rate of 1.1 percent, and a default rate of 3.1 percent. What is the NPV of extending credit for 30 days to all who are expected to become repeat customers? a. $17,984 b. $19,787 c. $12,304 d. $18,662 e. $13,609 29. The Electronics Store begins each week with 60 gadgets in stock. This stock is depleted and reordered weekly. The carrying cost per gadget is $21 per year and the fixed order cost is $45. What is the optimal number of orders that should be placed each year? a. 19 b. 27 c. 23 d. 15 e. 33 30. You are currently selling price of $199 s unit. Your variable gost of each unit is net 30 policy you 8 unis les only policy to nits ner month. The value of this switch using the accounts receivahle anproschorate is 1 2 percenr s e. $80.822 d. $76,516 e. $41 Chapter 19: Cash and Liquidity Management 31. RB Enterprise RBE) received an unexpected phone call from a competitor offering opportunity RBE assets to ment price. While RBE had not anticipated purch good to pass up. This illustrates which one of the following needs to hold cash? Precautionary was b. Transaction c. Speculative mpensation d e Eloat 32. Collection float: a. is more desirable to comp llation of a lockbox system. b. is totally eliminated c, exists when the available balance exceeds the book balance. d. can be avoided by collecting payments electronically at the time of sale. eliminated by implementing a concentration banking system. than disbursement float. e 33. Which one of the following is the least likely to reduce a company's total collection time? a. Assigning additional staff in the morning to process incoming payments b. Establishing preauthorized payments from customers c. Opening a post office box so mail can be received earlier in the morning d. Providing a discount for customers who pay electronically e. Depositing funds only at day's end 34. Which one of the following statements is correct concerning a cash management system that employs both lockboxes and a concentration bank account? a. All customer payments must be submitted to a lockbox b. The party that collects the checks from the lockbox is responsible for recording the payments on the customer's accounts. c. Payments received in a lockbox are transferred immediately to the concentration account. d. A higher dollar return may be earned on short-term investments due to the cash management system. e. The concentration account must be zeroed out on a daily basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts