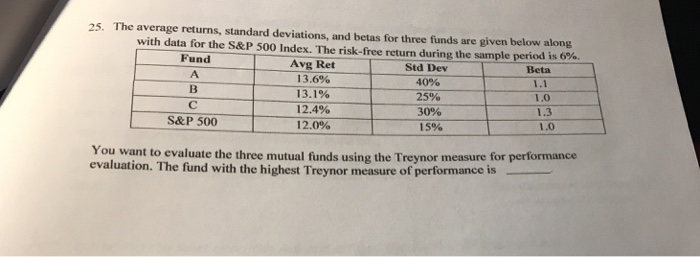

Question: 25. The average returns, standard deviations, and betas for three funds are given below along with data for the S&P 500 Index. The risk-free return

25. The average returns, standard deviations, and betas for three funds are given below along with data for the S&P 500 Index. The risk-free return during thesample period is 6%. Fund Beta Std Dev 40% 25% 30% 15% Avg Ret . 13.1% 12.4% 12.0% 1.0 1.3 1.0 S&P 500 You want to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of pert

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts