Question: 25. The correlation coefficient between the rates of return on two stocks measures: a. the degree to which the returns on the two stocks vary

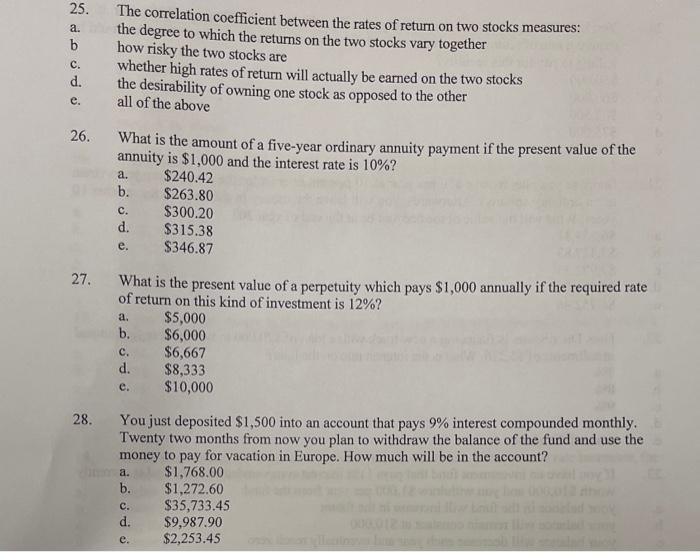

25. The correlation coefficient between the rates of return on two stocks measures: a. the degree to which the returns on the two stocks vary together b how risky the two stocks are c. whether high rates of return will actually be earned on the two stocks d. the desirability of owning one stock as opposed to the other e. all of the above 26. What is the amount of a five-year ordinary annuity payment if the present value of the annuity is $1,000 and the interest rate is 10% ? a. $240.42 b. $263.80 c. $300.20 d. $315.38 e. $346.87 27. What is the present value of a perpetuity which pays $1,000 annually if the required rate of return on this kind of investment is 12% ? a. $5,000 b. $6,000 c. $6,667 d. $8,333 e. $10,000 28. You just deposited $1,500 into an account that pays 9% interest compounded monthly. Twenty two months from now you plan to withdraw the balance of the fund and use the money to pay for vacation in Europe. How much will be in the account? a. $1,768.00 b. $1,272.60 c. $35,733.45 d. $9,987.90 e. $2,253.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts