Question: 2:52 1. Back Chapter 6 - Assignment 3.docx Topic: LIFO Reserves LO: 7 Longhorn Software Company's 2016 balance sheet reveals that inventories reported on a

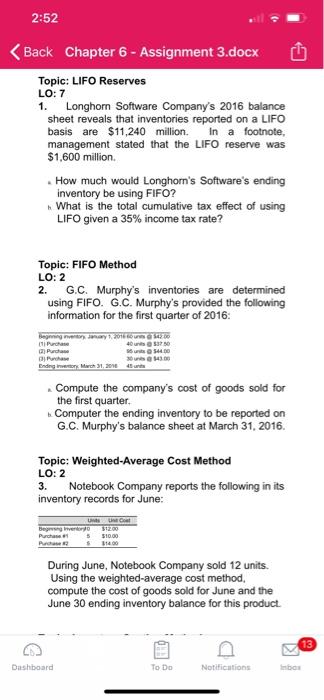

2:52 1. Back Chapter 6 - Assignment 3.docx Topic: LIFO Reserves LO: 7 Longhorn Software Company's 2016 balance sheet reveals that inventories reported on a LIFO basis are $11,240 million. In a footnote management stated that the LIFO reserve was $1,600 million How much would Longhorn's Software's ending inventory be using FIFO? What is the total cumulative tax effect of using LIFO given a 35% income tax rate? Topic: FIFO Method LO: 2 2. G.C. Murphy's inventories are determined using FIFO. G.C. Murphy's provided the following information for the first quarter of 2016: Enging new 11 Purchase he Ending into a 3000 Compute the company's cost of goods sold for the first quarter. Computer the ending inventory to be reported on G.C. Murphy's balance sheet at March 31, 2016. Topic: Weighted-Average Cost Method LO: 2 3. Notebook Company reports the following in its inventory records for June: Bergvertory$12.00 Paches 12.00 During June, Notebook Company sold 12 units. Using the weighted-average cost method, compute the cost of goods sold for June and the June 30 ending inventory balance for this product. 'G 13 Dashboard To Do Notifications be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts