Question: A company is considering two mutually exclusive risky investment projects: Project X requires an initial capital investment of $100,000, has zero salvage value and

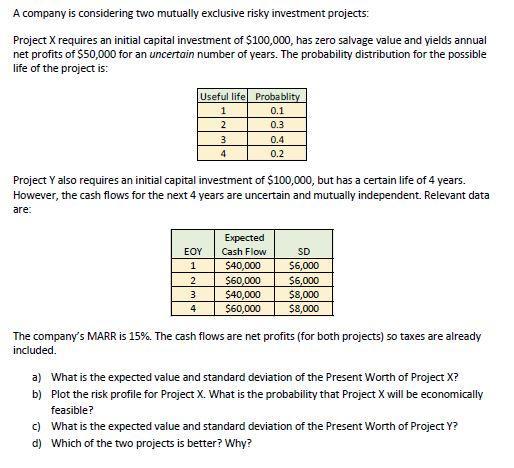

A company is considering two mutually exclusive risky investment projects: Project X requires an initial capital investment of $100,000, has zero salvage value and yields annual net profits of $50,000 for an uncertain number of years. The probability distribution for the possible life of the project is: Useful life Probablity 0.1 0.3 1 2 EOY 1 2 3 4 3 4 Project Y also requires an initial capital investment of $100,000, but has a certain life of 4 years. However, the cash flows for the next 4 years are uncertain and mutually independent. Relevant data are: Expected Cash Flow 0.4 0.2 $40,000 $60,000 $40,000 $60,000 SD $6,000 $6,000 $8,000 $8,000 The company's MARR is 15%. The cash flows are net profits (for both projects) so taxes are already included. a) What is the expected value and standard deviation of the Present Worth of Project X? b) Plot the risk profile for Project X. What is the probability that Project X will be economically feasible? c) What is the expected value and standard deviation of the Present Worth of Project Y? d) Which of the two projects is better? Why?

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

ANSWER a The expected value of the present worth of Project X is 500000 and the standard deviation is 300000 b The risk profile for Project X is as fo... View full answer

Get step-by-step solutions from verified subject matter experts