Question: 26 , 31 , 32 , 33 , 34 please Unit 15.4 Repayment variations and loan charges 25. You get a 30-year ARM at a

26 , 31 , 32 , 33 , 34 please

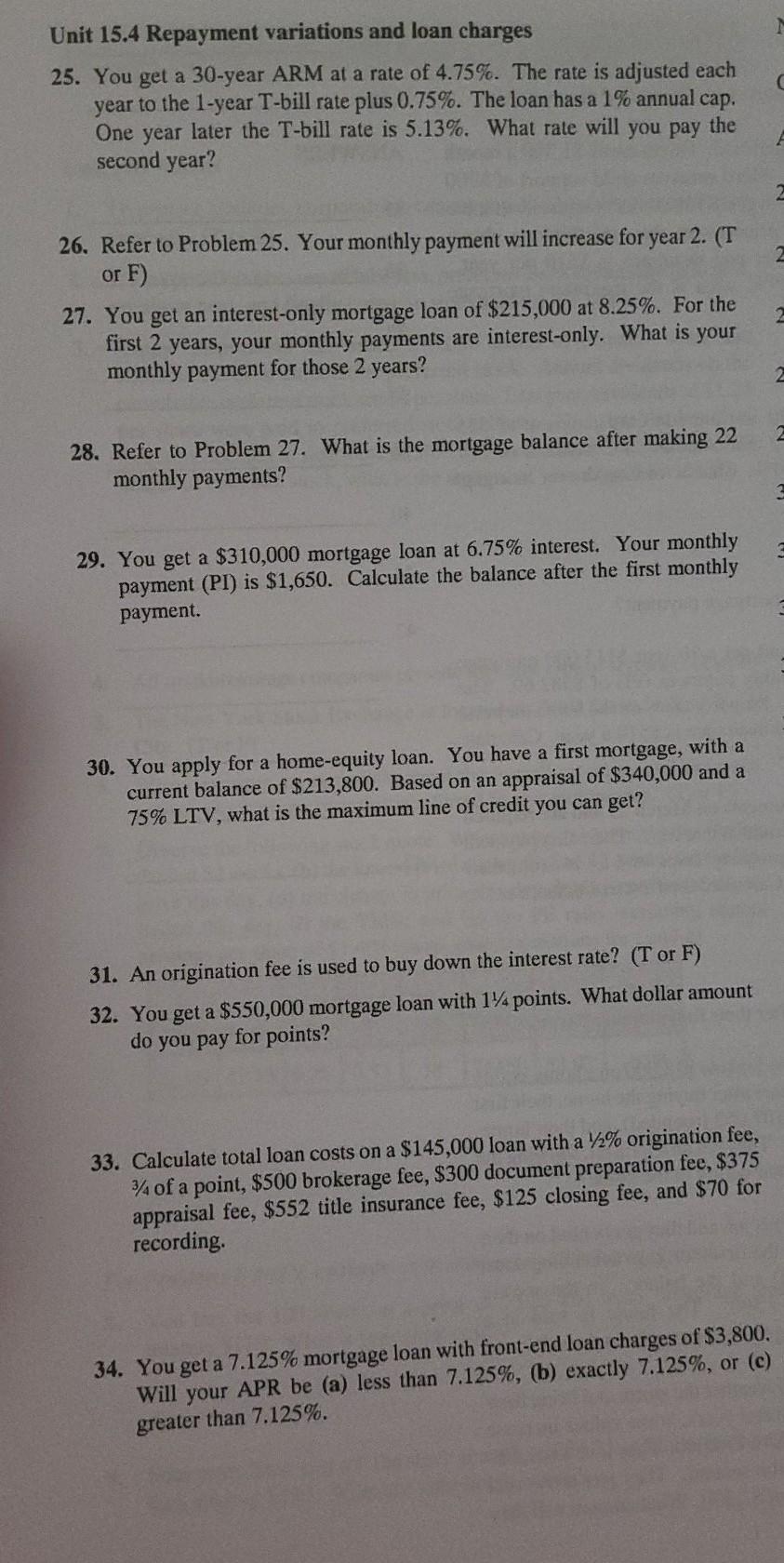

Unit 15.4 Repayment variations and loan charges 25. You get a 30-year ARM at a rate of 4.75%. The rate is adjusted each year to the 1-year T-bill rate plus 0.75%. The loan has a 1% annual cap. One year later the T-bill rate is 5.13%. What rate will you pay the second year? 26. Refer to Problem 25. Your monthly payment will increase for year 2. (T or F) 27. You get an interest-only mortgage loan of $215,000 at 8.25%. For the first 2 years, your monthly payments are interest-only. What is your monthly payment for those 2 years? 28. Refer to Problem 27. What is the mortgage balance after making 22 monthly payments? 29. You get a $310,000 mortgage loan at 6.75% interest. Your monthly payment (PI) is $1,650. Calculate the balance after the first monthly payment. 30. You apply for a home-equity loan. You have a first mortgage, with a current balance of $213,800. Based on an appraisal of $340,000 and a 75% LTV, what is the maximum line of credit you can get? 31. An origination fee is used to buy down the interest rate? (T or F) 32. You get a $550,000 mortgage loan with 1/4 points. What dollar amount do you pay for points? 33. Calculate total loan costs on a $145,000 loan with a 12% origination fee, 74 of a point, $500 brokerage fee, $300 document preparation fee, $375 appraisal fee, $552 title insurance fee, $125 closing fee, and $70 for recording. 34. You get a 7.125% mortgage loan with front-end loan charges of $3,800, Will your APR be (a) less than 7.125%, (b) exactly 7.125%, or (c) greater than 7.125%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts