Question: 26). a. b. What is the difference between a traditional IRA and a Roth IRA? Choose the correct answer below. O A. In the traditional

26).

a.  b.

b.

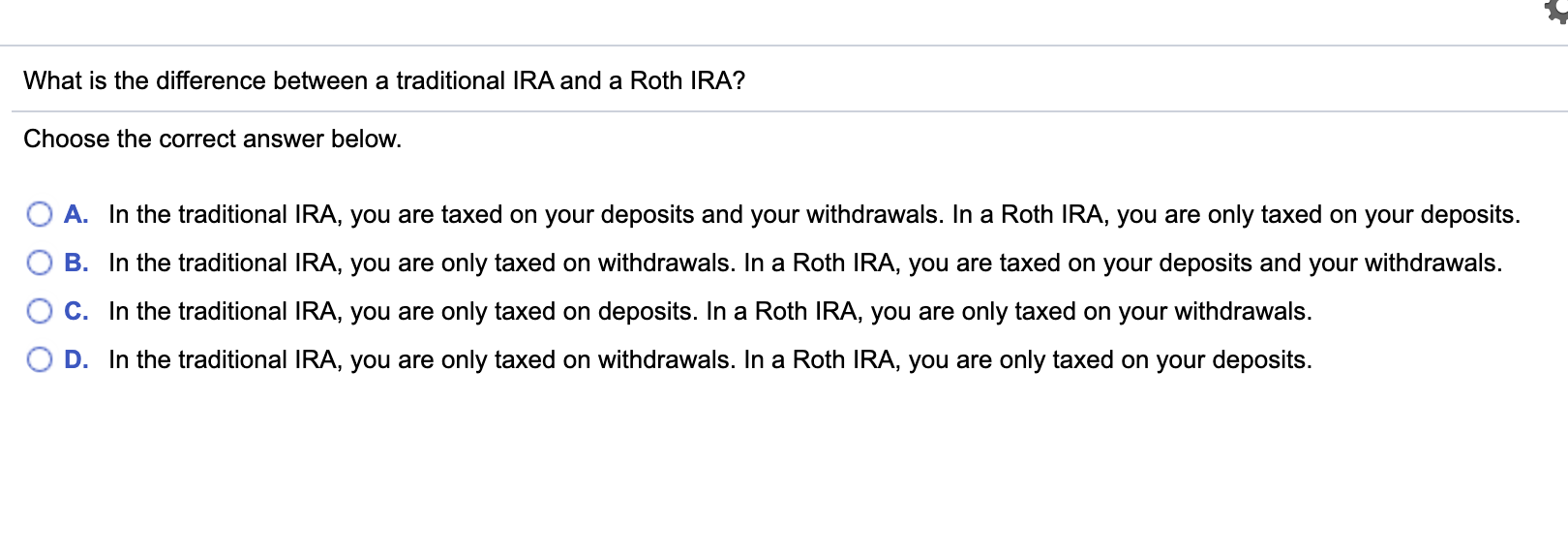

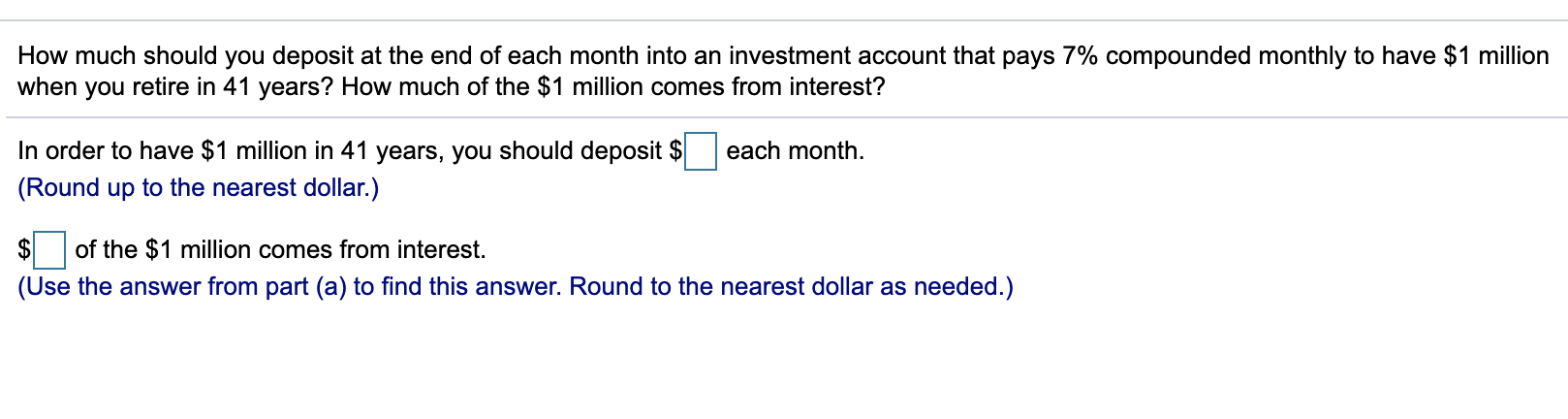

What is the difference between a traditional IRA and a Roth IRA? Choose the correct answer below. O A. In the traditional IRA, you are taxed on your deposits and your withdrawals. In a Roth IRA, you are only taxed on your deposits. B. In the traditional IRA, you are only taxed on withdrawals. In a Roth IRA, you are taxed on your deposits and your withdrawals. C. In the traditional IRA, you are only taxed on deposits. In a Roth IRA, you are only taxed on your withdrawals. D. In the traditional IRA, you are only taxed on withdrawals. In a Roth IRA, you are only taxed on your deposits. How much should you deposit at the end of each month into an investment account that pays 7% compounded monthly to have $1 million i retire in 41 years? How much of the $1 million comes from interest? when you each month. In order to have $1 million in 41 years, you should deposit $| (Round up to the nearest dollar.) of the $1 million comes from interest. (Use the answer from part (a) to find this answer. Round to the nearest dollar as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts