Question: 26. a. Determine the expected return and beta for the following portfolio: Stock % of Portfolio Beta Expected Return 1 40% 1.00 12% 2 25

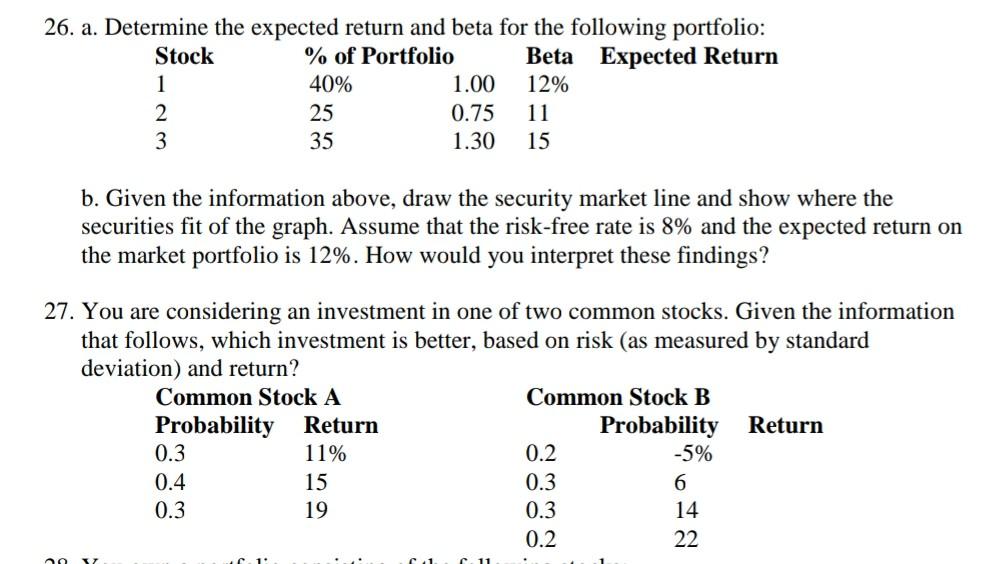

26. a. Determine the expected return and beta for the following portfolio: Stock % of Portfolio Beta Expected Return 1 40% 1.00 12% 2 25 0.75 11 3 35 1.30 15 b. Given the information above, draw the security market line and show where the securities fit of the graph. Assume that the risk-free rate is 8% and the expected return on the market portfolio is 12%. How would you interpret these findings? 27. You are considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on risk (as measured by standard deviation) and return? Common Stock A Common Stock B Probability Return Probability Return 0.3 11% 0.2 -5% 0.4 15 0.3 6 0.3 19 0.3 14 0.2 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts